Anyone in the jewellery or related industries can’t open their laptop without being hit by another doom-laden headline about diamond prices.

The latest reports declare that Anglo American, the majority owner of De Beers, has published another vast write-down of its investment. Meanwhile, Alrosa, the Russian diamond giant, has been propped up by the Russian government. Both companies are reportedly stockpiling around $2 billion worth of unsold diamonds in an increasingly challenging global market, driven by geopolitical tensions and advancing technology.

These are mining giants, and the headlines are dramatic. However, it takes around two years for a diamond to move from the mine to the shop window. This is a crucial factor when valuing an engagement ring. Despite the headlines, these market shifts do not immediately affect valuations or replacement costs. Diamond prices fluctuate constantly, and experienced valuers rely on top trade sources such as RapNet. The best valuers consult at least three independent sources for each stone they assess.

A knowledgeable valuer will also understand the impact of Russian sanctions introduced in 2024, the conflict in the Middle East, and the downturn in Chinese middle-class spending. All of these factors influence diamond pricing and the ability to source replacements in case of loss.

The Danger of Headlines

Professional brokers, insurers, and jewellery owners are often short on time, scanning dozens of headlines each day. Decisions made solely on headlines risk being based on incomplete or misleading information. At worst, they could be influenced by an opinion piece paid for by a company with something to sell.

Diamonds hold a unique place in the retail market, as they have for centuries. Once reserved for royalty and the wealthiest elites, diamonds became a mainstream expectation by the 1950s, particularly as engagement rings for modern, independent women.

The Perception of Falling Prices

“But diamond prices are falling,” you may say.

Historically, younger buyers and the bridal market have been major consumers of small natural diamonds. However, over the past decade, their social feeds have been flooded with man-made diamonds (not ‘laboratory-grown’ which is a misnomer) and high-quality, stylish dress jewellery from brands like TJC and Pandora. The shift in pricing, environmental concerns, and changing consumer preferences have had a major impact on the lower-to-mid market.

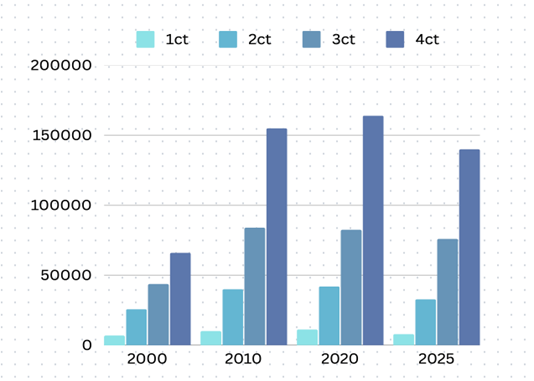

It is true that diamonds under 1.50ct have seen price drops, in some cases by as much as 30%, as their key buyers have moved away.

Prices are per diamond for a round brilliant cut, F colour VS1 clarity GIA diamond Report in March of each year.

These are approximate selling prices in the UK at that time with the historic approximate retail margins and timely interest rates taken into consideration.

But Do Not Be Fooled

The high-net-worth market is thriving.

Diamonds over 2ct have always been beyond the reach of most buyers, making them the preferred size for professionals and affluent individuals. Second marriages, milestone anniversaries, or the sale of a business often drive purchases at this level. This is not the market that man-made diamonds have disrupted.

For high-net-worth and ultra-high-net-worth clients, jewellery values are not falling. Rubies bought in the 1990s, heirloom Art Deco and Cartier pieces, and upgraded engagement rings all hold their worth. In fact, many of my clients own multiple engagement rings, one for weekday wear and another for weekends.

Man-made diamonds are certainly purchased, but often as travel jewellery or gifts for daughters rather than as investment pieces.

A glance at recent fine jewellery auctions shows that branded vintage pieces from Cartier, Verdura, and Van Cleef & Arpels continue to command strong prices, along with larger, certified diamonds. These are not easily replaced and require an expert valuer to determine a proper replacement figure. Some brands such as Cartier and Tiffany increase their prices twice a year. On average the basic beautiful LOVE bangle from Cartier increases £300 every year.

| New | ||

|  | |

| Pragnalls Jewellers 1.51ct - £18,000 | Pragnalls Jewellers 3.02ct - £74,650 | |

| Second Hand | ||

|  |  |

| Cartier yellow and white diamond cross over ring Wooley & Wallis auctioneers Estimate £4-6k Hammer £9.5k | Victorian antique cluster ring Harper Field Auctions Estimate £8,500 - £10,500, Hammer £28,500 | 1980's Cartier Panthere earrings $66,000 at Opulent Jewellers - USA |

Additional Factors

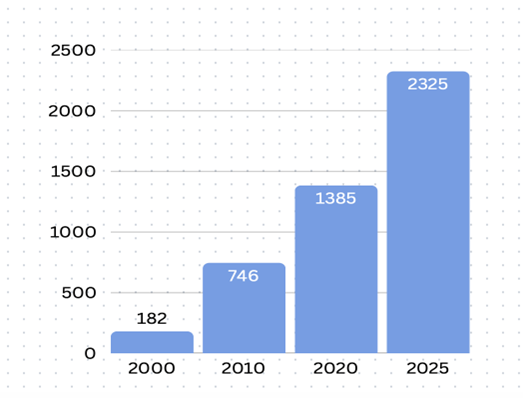

Another important factor is the price of gold – the value of a 1 Troy Ounce of gold has increased 819% from 2000 – 2024, as displayed in this graph:

Pound / Dollar interest rates have fallen and retail margins have had to be pared back to compete with global and technological competition and wages for goldsmiths, polishers, cutters, apprentices, setters have in some cases tripled since 2000.

The Role of Professional Valuers

Valuing jewellery, like the value of a car, is a sum of its parts plus the brand, popularity, rarity and condition. One would not stop valuing cars because the price of steel had dipped. So too is the case for the valuation of diamond jewellery even when the markets are in flux.

Jewellery valuation is a specialised profession that does not always get the credit it deserves. It requires years, often decades, of expertise, and valuers do not typically shout about their knowledge.

But in a world flooded with misinformation and sensational headlines, their insight is more relevant than ever.

So, where do you get your information?

To arrange a jewellery valuation call us on 01883 722736 or [email protected]

Annabell Parry

Annabell has worked with international fine jewellery and watch brands for over 20 years. During those 25 years, she attained internationally recognised industry qualifications and affiliations and is a Registered Valuer with both valuing institutes of the United Kingdom.

- Annabell Parry#molongui-disabled-link

- Annabell Parry#molongui-disabled-link

- Annabell Parry#molongui-disabled-link

- Annabell Parry#molongui-disabled-link