The Case for Up-to-Date Jewellery Valuations in a Rapidly Shifting Market

Gold at an all-time high, diamonds in freefall, ruby values that look like telephone numbers. Welcome to jewellery valuations in 2025 as the jewellery market is moving and shifting at great speed and it can sometimes be difficult to keep up.

Which is why it is so important you have your appraisals up to date.

The global diamond jewellery market reached £46 billion in 2023, £49.3 billion in 2024 and is set to reach over £90 billion by 2032. Why the continuous rise? Let’s explore a few key areas impacting jewellery value and market trends.

It’s been an interesting year for everyone but for insurance teams that depends on accurate and dependable valuations, then it’s become increasingly vital to work with valuation specialists.

For a private client to ensure your values are up to date and you are not going to have a shock in the event of a claim, a valuation needs to be within the last 24 months.

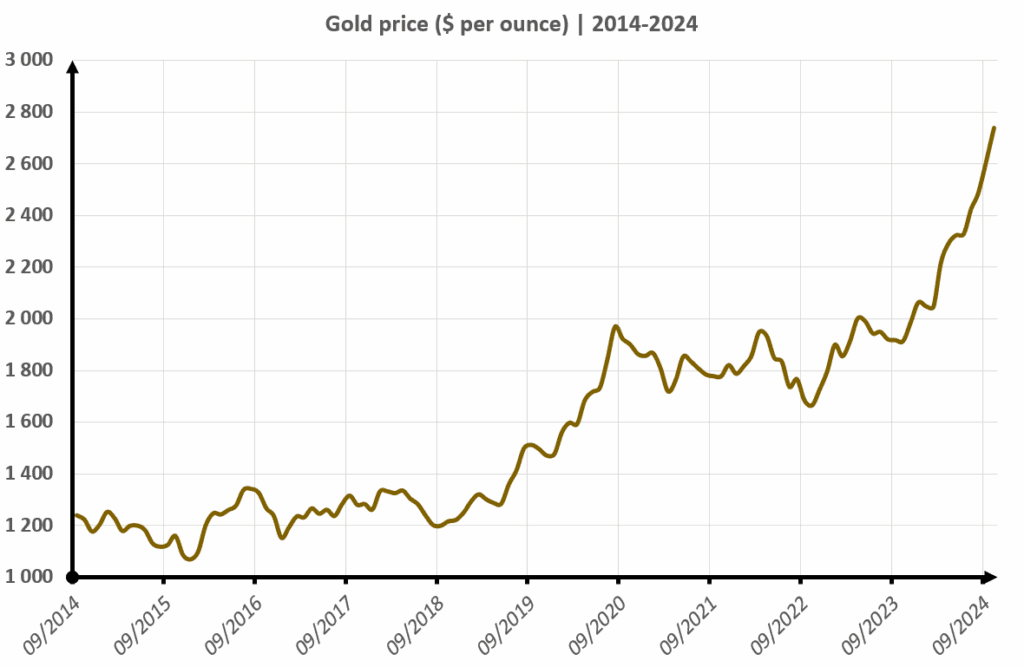

Look at any jewellery auction across the country this year and every heavy gold piece will have early offers ahead of the auction. Small time gold buyers have sprung up all over the country and are making the most of the increasingly high gold bullion price.

Brick and mortar jewellers are reviewing their prices every three months and this week I received an email from a goldsmith who I regularly use stating;

“All gold prices are estimated at present, we advise that the final bill will be slightly amended due to the fluid nature of the gold price”. To qualify the need for this unusual statement, as I write pure Gold is trading at $2481 per troy ounce. It was $1805 per ounce 12 months ago.

Insurers and their clients need to be reviewing their policies, not just for gold.

Diamonds – What price difference are we talking about?

Comparatively, a De Beers ring set with a brilliant-cut diamond weighing 0.51 carat, G colour and VS1 clarity retails for £5,900. Pandora offers the same diamond, but lab-grown for £825. There’s no denying the price tag is attractive and not surprising that they are projected to represent 25% of the market by 2030.

Another shift is the confidence in online shopping and the rise of E-Commerce. Consumers will spend a great deal more without seeing the item than they did prior to Covid. A recent study showed that online jewellery sales had gone up by 30% during that period.

Art Deco Tutti Frutti bracelet by Cartier – This stunning bracelet came up for sale at Sotheby’s on 28th April 2020 over the course of a four-day sale, online only due to confinement restrictions. It sold for £1 million and set a world record for any jewel sold online and any jewel sold in 2020.

When reputation and trust precede a brand, clients will happily buy blindly. And that is what luxury brands are banking on and it’s working. There is a steady continuous increase in prices each year on the most popular items.

A pair of Tiffany & Co. Victoria diamond earrings have gone from £3,100 in 2003, to £4,925 in 2010, £8,775 in 2021 and up to its current value of £9,125.

There are no signs of slowing down for luxury brands. When it comes to branded pieces, such as De Beers or Tiffany & Co. it still seems to be a safe investment with return on investment definitely worth the waiting for. With values of signed pieces creeping up and diamond markets fluctuating as do the insurance values.

Rubies and sapphires have seen some big increases. If your clients’ purchased sizable gemstones in the 1960’s,70’s,80’s, 90’s ( before excessive treatments became the norm) then these gems are very attractive to the market. There are simply not enough to fill demand.

Interestingly there is far less demand for emeralds at present! But, that could change due to fashion or popularity (if the stars start wearing emeralds, we could see market changes)!

The big question over the next 18 months will be how to value diamonds? Natural diamonds that is.

It is now common knowledge that manufactured diamonds (also known as Lab grown diamonds) currently change hands for about 5-15% of their natural counterparts. If you would like to know a little more as to why this is do look back at some of the previous articles. Manufactured diamonds are here to stay and have found a home in the Bridal and costume jewellery market. This has sent the market for smaller, natural lower quality diamonds tumbling. Why have a lower quality smaller natural stone when you could have a fine colour and clarity manufactured earring set which you don’t mind losing on the beach!

However, the smart minds will be watching the bigger, higher quality natural stone prices. That is diamonds over 3ct, G/H colour and above with a good cut and proportions.

Why? Because these will be in smaller and smaller supply in the coming years – and we are already seeing the effect at the point of sale both on the high street and at auction.

American Tariffs, the Urakian / Russian conflict and the Israeli/ Palestinian conflict have interrupted the long-established routes for rough diamond via the cutting centres to the waiting consumer. This is a subject, in its own right, to explore in the future.

There are still plenty of diamonds to purchase in Europe. Despite Americans holding tight onto their precious stocks as increased tariffs mean they cannot competitively purchase at the moment.

The stock of the better-quality stones, so loved by high-net-worth clients, may well start to dry up due to the convulsing diamond industry and therefore those prices will rise. These thoughts have been recently reinforced following published comments from the London diamond Bourse and Diamnet Founder Howard Levine.

This is a defining period for the jewellery trade as rarity, real luxury, taste and craftsmanship will continue to be sought out. These rare pieces, newly purchased or family held, need to be valued effectively and not be confused and undervalued with the mass produced, lower quality pieces.

The need for a valuation – for clients who haven’t had their jewellery values in the last 24 months, they will see a difference in valued and could find any claim could be problematic without one. Applying generic inflation percentages as a tool to update valuations, would be incorrect and inevitably lead to jewellery being under or over insured.

Because jewellery is the product of so many moving parts, it is essential to revalue one’s jewellery collection on a regular basis. Prices may vary several times within a single calendar year and our recommendation would be to get an official jewellery valuation at least every other year. And while your specialist is there, make sure every clasp and setting of stones is checked. A lost stone has monetary value but, in most cases, the emotional attachment to the piece makes the gem priceless and irreplaceable.

Annabell Parry

Annabell has worked with international fine jewellery and watch brands for over 20 years. During those 25 years, she attained internationally recognised industry qualifications and affiliations and is a Registered Valuer with both valuing institutes of the United Kingdom.

-

Annabell Parry#molongui-disabled-link

-

Annabell Parry#molongui-disabled-link

-

Annabell Parry#molongui-disabled-link

-

Annabell Parry#molongui-disabled-link

Aurélia has over twenty years’ experience in the auction industry. She started her career in Business Development and Client Services at Christie’s and Sotheby’s Paris.

-

Aurélia Turrall#molongui-disabled-link

-

Aurélia Turrall#molongui-disabled-link

-

Aurélia Turrall#molongui-disabled-link

-

Aurélia Turrall#molongui-disabled-link