2023-2024 has been a deeply complex year all round; the world has had to navigate the continuing conflict in Ukraine, the ongoing volatility in the global financial markets and high inflation and interest rates, together with the increasingly tense and brutal situation in the Middle East. This combination of factors does not breed economic confidence and positivity, but rather caution and concern. This is also true of the art market, which is inextricably linked to the economic markets. 2023-2024 has been a year of contraction and reassessment.

The escalating inflation and other economic concerns in different regions have directly impacted available discretionary income and subsequent spending for many collectors. Even for high-net-worth (HNW) collectors, who may have been less impacted by cost-of-living hikes, concerns over wealth creation and its stability affected their willingness to make discretionary purchases and sales, while volatile social and political issues weighed on sentiment and distracted their focus from their collections.

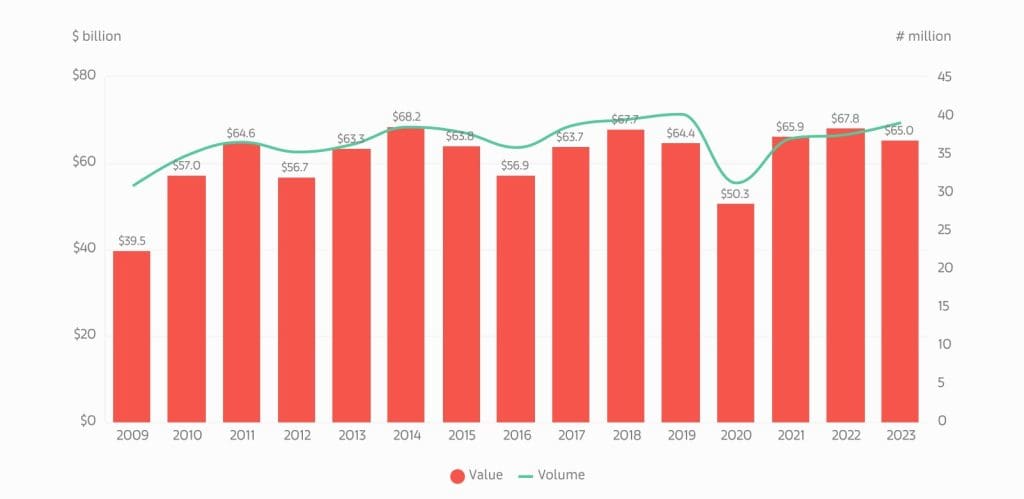

The two years following the Covid pandemic, saw the art market recover and the general outlook become more positive. Sales increased across all sectors, which saw rapid and expansive growth, with the market reaching new heights – culminating in 2022 with global art sales of $67.8 billion.

In 2023 and 2024, the trickle-down effect from the global economy hit the art market, which saw a noticeable but not drastic 4% downturn, resulting in $64.4 billion global sales across all sectors and regions. Considering the significant external factors at play, this 4% fall has been surprisingly modest. The auction houses saw a greater fall than dealers, losing 7% of their sales versus 3% for dealers.

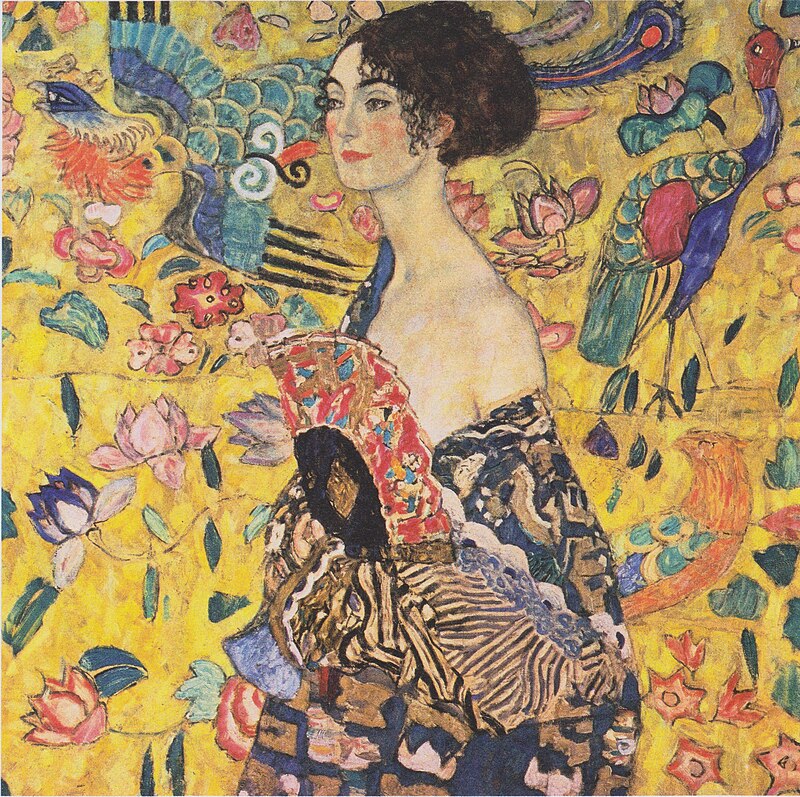

Interestingly, it has been the lower to mid end of the art market that has fared better than the top of the market. This is unusual as normally in times of economic and political upheaval, the blue chip dominated top end of the market tends to be recession proof – quality is always demand and carries a premium. In this case, however, the relatively heavier downturn at the top of the market was reflective of a lack of supply to the market rather than a lack of money or interest. Major collectors have been reluctant to let major works from their collections go to auction when there is an underlying concern about the economic future. Much of this caution is misplaced, the appetite and money to buy great things still exists, as is evidenced by a slew of strong prices achieved by the major works which did make it to the market – most notably the $139.4m for Picasso’s 1932, Femme à la montre, or the £85.3m for Klimt’s Lady with a Fan. The lower to mid-level of the market had no such issues, with a healthy supply fuelling an increase in overall global sales transactions of 39.4 million (albeit at a lower level).

One of the main reasons for the relatively modest aggregate downturn in the art market has been differences in the performance of sales in some of the major global art markets – some have fallen but some have risen to counter this.

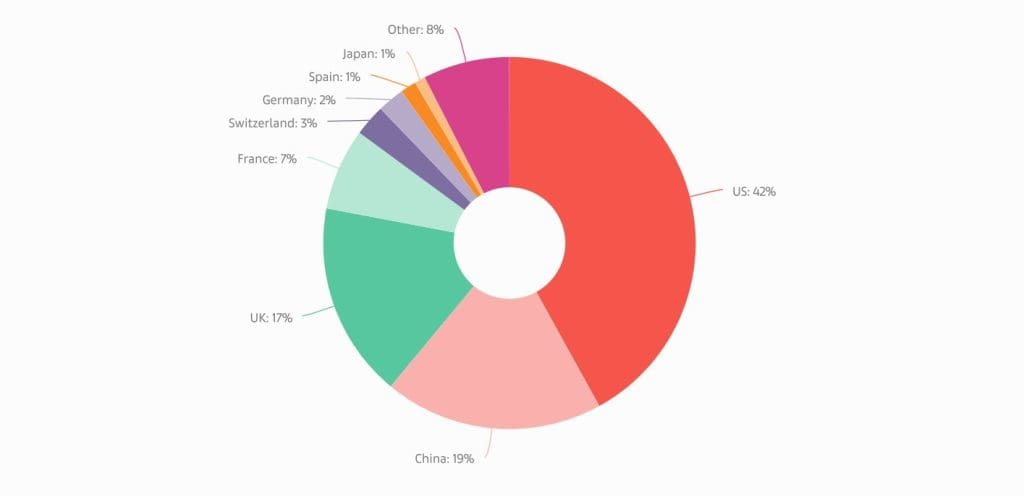

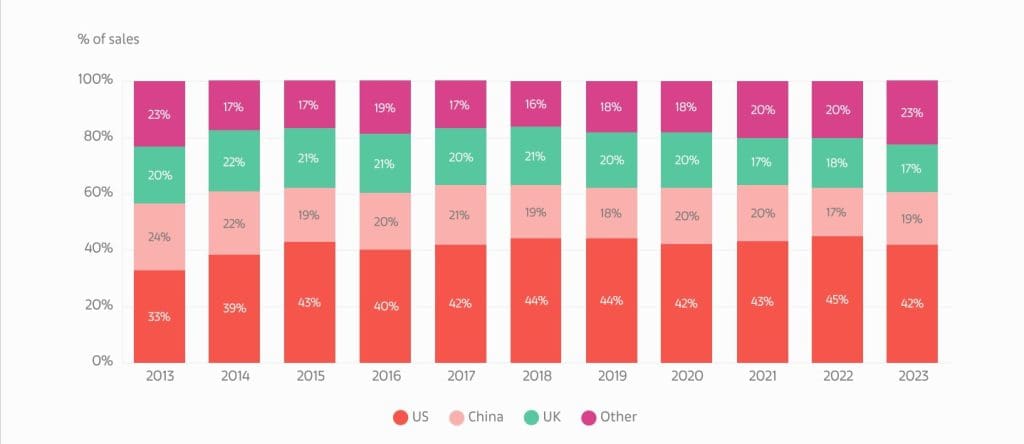

Historically, the three main players in the art market geographically have been the US, Britain and Asia represented by China in its entirety, including Hong Kong and Singapore. Within this group, the US is, and has always been, the senior partner. The US has the largest concentration of art buying wealth anywhere in the world, it is where the largest financial art transactions occur, and the where the most prominent auctions take place. In spite of this though, in 2023-2024 the US art market dropped by a significant 10% to $27.2 billion, which represents 42% of the global art market. This was predominantly due to the shrinking of the top end of the market.

In contrast, for the first time ever, China out stripped the UK to reach second place, up 19%, with sales of $12.2 billion. The rapid growth in the Chinese market balanced out the drop in the US and UK markets, resulting in the small global aggregate drop of 4%. China’s sudden growth was a result of their delayed bounce back from the COVID crisis – whereas the West came out of lockdown in 2021 and experienced a surge in economic growth; China on the other hand experienced harder and longer lock downs, only coming out of COVID recession in 2022-2023. Their economic boom was therefore felt in 2023, with their population eager to enter the market again with enthusiasm. Also, many auctions which had been cancelled due to COVID were rescheduled for 2023 and early 2024, resulting in a significant spike in sales.

Historically, whilst Paris has been Europe’s centre of creativity, London has been the great centre of European art trading. In 2023, however, the UK fell to third place globally, down 8% with $10.9 billion. Much of that was due to China’s surging market, but the effects of Brexit were also a significant contributing factor. The increased difficulty and cost of trading in the UK, due to increased bureaucracy and import duties, have had a very real effect on the art market. Add to this, the indefinable impression felt internationally that London has lost its way somewhat and is not open to business as it used to be, has contributed to the UK’s art market decline in sales.

The growth of online digital sales has continued in tandem to traditional sales. The COVID crisis was pivotal in the push towards online sales, as it was a essential to the survival of the art market at the time. In 2023-2024, online sales rose 7% on 2022 figures to $11.8 billion, representing 18% of all art sales. This figure will do doubt continue to rise as collectors become more tech savvy and comfortable, however, the value of individual purchases remains relatively low – under $50,000. It seems that at the higher level of transactions, collectors still want to touch noses with the artwork before committing!

Whist the art market did contract by 4% in 2023-2024 due to various global economic and geopolitical factors, the market has stayed remarkably strong, nonetheless. Money has not disappeared, nor that the collector base, what has changed is that market is now more a buyer’s market rather than a seller’s market – the inflated hot air has left the room. That said, great things still made very strong prices when they came to the market as evidenced by the following master works which for sale last year.

If you would like an art valuation, get in touch by calling us on 01883 722736 or email us at [email protected].

Ben is an established contemporary art specialist. He began his career working in the Old Master and 20th Century markets before moving into the contemporary market. He has over 20 years’ experience working in the UK and international art markets.

- Ben Hanly#molongui-disabled-link

- Ben Hanly#molongui-disabled-link

- Ben Hanly#molongui-disabled-link

- Ben Hanly#molongui-disabled-link