If you have never needed a valuation completed, the cost is not as much as one might think and the easiest way to find out is to ask for a detailed quotation. As we charge on a time basis, all we need to know is the number of pieces, briefly what they are and your location.

Why do you need a valuation?

If you find yourself in a situation whereby you suffer a loss and need to make a claim on your insurance, the first questions you need to ask yourself are;

1. Can I show what the item was and that I owned it?

2. Do I have a detailed listing or the original receipt and a photograph of the item?

3. Do I know the value of the piece?

The easiest way to protect your jewellery in the event of a loss or damage is to insure it for its true value which will require a regular and up-to-date valuation. So, in the event of a loss you can provide your insurer with all of the above details easily and with as little fuss or inconvenience as possible.

A valuation will provide you with a document giving you a detailed description of the item(s), to include details of the stone, size, metal etc… and providing a value. If the diamond is certified, the certificate number should be noted within the description, as well as the name of the grading laboratory. It should be dated and also stated exactly what type of valuation it is. For insurance purposes, you will be looking for a value that will enable you to replace your treasured piece. Our specialists will always discuss with you about how you would choose to replace the item in an event of a loss. Many insurers apply a ‘New for Old’ replacement clause to Jewellery and Watches however if your ring is antique or obsolete our valuations will reflect this within our report and base of value on either a second-hand replacement value or secondary market replacement. We also check all clasps and settings of your jewellery as many insurers have a ‘Clasps and Settings clause’ in their policies which you may not be aware of until you suffer a lost.

Asprey. A three stone diamond ring

Value in 2005 – £26,000

Value in 2012 – £33,000

Value today – £54,500

Insurers may only ask you to provide a valuation for items over £20, £30 or £50,000 depending on the insurer – however, we always ask a client if they can provide ownership, show what the items were and values in the event of a claim. This is always a ‘no’ in most cases… so, what happens in the event of a claim?

Without a valuation, insurers often use claims management specialists to try to find the value of jewellery after it has gone – an unsatisfactory process known as a post-loss valuation. Valuing something after you have lost it often results in an under-assessment of the lost item’s true value or not having your claim paid at all. We are asked to review photographs on a regular basis of jewellery that has been stolen, asking us if we can value it post loss, unfortunately without being able to see the piece and examine the piece we cannot provide a value.

Often this is a very distressing time which could have been avoided with a professional valuation.

So, when you need your jewellery and watches appraised, you can put your trust in us to look after you.

A diamond Solitaire ring

Purchased 1999: £15,000

Valued in 2010: £22,000

Algorithm calculation £23,552 (index linked value insured for!)

Correct Value: £40,750

Our valuations follow a successful method that works by being an in depth, and cost effective process; Our specialist will attend your home – all of our team have formal qualifications and substantial experience within the industry and provide a friendly and professional service. Our team of administrators will look after you from the point of contact to you receiving your report within 15-20 days of your appointment.

Patek Philippe. A Nautilus 40th Anniversary Limited Edition Flyback Chronograph watch

Value in 2016 – £ 75,000

Secondary Market value – £400,000+ (now discontinued)

Now more than ever it is so important that your jewellery values and listings are up to date with your insurance company.

Once you have a valuation completed by us, we hold this information on our secure database, so in the event of any loss we assist you with your claim and provide an up to date value, which will ensure you receive the correct compensation enabling you to replace your item.

The most important reasons for a valuation are;

• In order to be fully insured, your jewellery needs to be listed separately on your Home Contents Policy with a broker who offers a bespoke policy.

• When you need to claim the valuation will provide you with

o Proof of ownership

o A detailed description of the item

o Proof of value

Without them you may end up with an unfair settlement, and no way of proving it.

• The valuation reports will increase your chances of successful recovery by the Police and addition to any registers.

Graff. A ruby and diamond Lotus pendant and earrings

Value in 2015 – £102,740

Valued today – £135,000

Like all markets, the price of silver, gold and diamonds go up and down as do the costs of manufacturing. All diamonds are traded around the world in US dollars, so exchange rates also affect todays values.

We strongly recommend a valuation is updated every 3 years however, if you are a collector of watches you may want to review these values annually as we have seen many makers discontinue certain styles which can increase their values.

Finally, always ensure you are using a reputable company when having a valuation completed and ensure you receive a copy of their Terms and Conditions of Business and they have at least £5m Professional Indemnity Insurance which is an industry standard.

Call us today for a quotation on 01883 652402 or email [email protected] and speak with Rachel. Our specialists cover the whole of the UK and Europe.

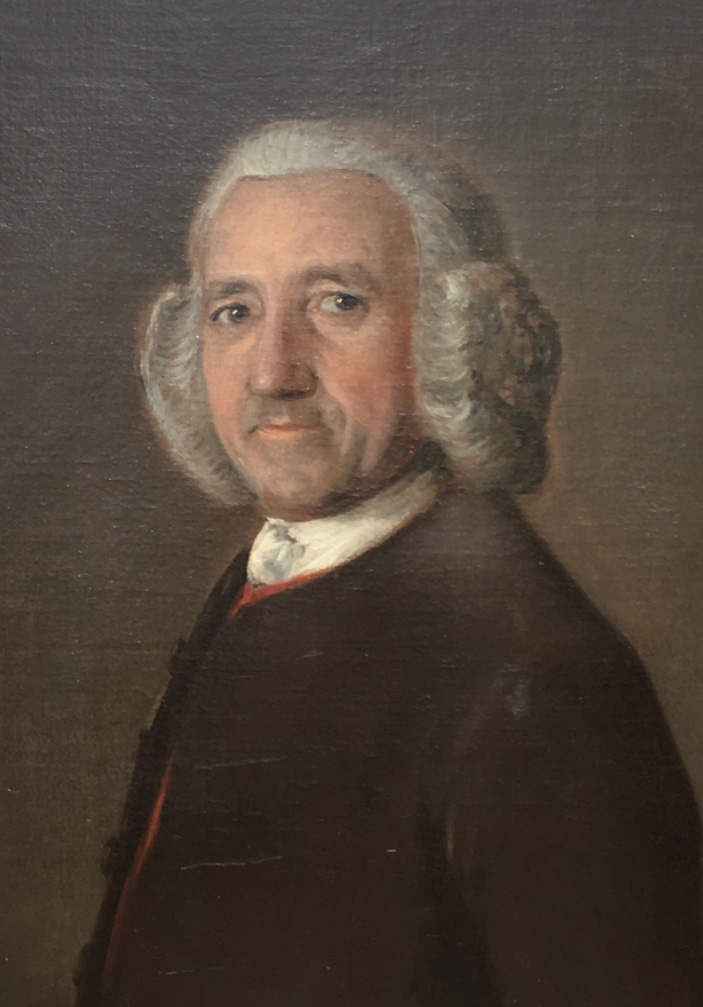

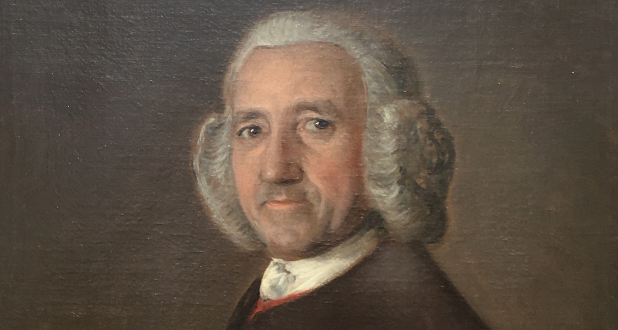

Thomas Gainsborough, R.A. (British, 1727-1788)

Thomas Gainsborough, R.A. (British, 1727-1788)