In 2014, Sotheby’s sold a copy of ‘Mirth Without Mischief’ for $23,750, dating from 1780 in which the first version of the famous Christmas carol Twelve Days of Christmas appeared for the first time.

Some historians believe it could be French and could have been created as a memory game, to help Christians learn and remember the principles of their faith. Though this could and has been refuted by some, let’s have a look at what is gifted during the Twelve Days of Christmas.

On the first day of Christmas, my true love gave to me a partridge in a pear tree.

Day 2: two turtle doves

Day 3: three French hens

Day 4: four calling birds

Day 5: five gold rings

Day 6: six geese a-laying

Day 7: seven swans a-swimming

Day 8: eight maids a-milking

Day 9: nine ladies dancing

Day 10: 10 lords a-leaping

Day 11: 11 pipers piping

Day 12: 12 drummers drumming

Someone on the internet has very kindly converted what the cost of all those presents would be in today’s currency and this comes to approximately £35,000.

With this budget, here is my choice for what I would wear during the Twelve Days of Christmas.

The Twelve Days start on the 25th December, and in keeping with the festive red and religious aspect of the celebrations, an early 19th Century garnet and pearl cannetille cross pendant, which sold at Bonhams for £1,500.

On the 26th, with the nights still closing in early, a moonstone necklace such as this Edwardian pendant necklace selling for £995, to shimmer and capture all the starlight.

On the 27th, an emerald and diamond three-stone ring, such as the below selling for £2,950 at Fenton to echo the Christmas tree which might be losing a few needles by now…

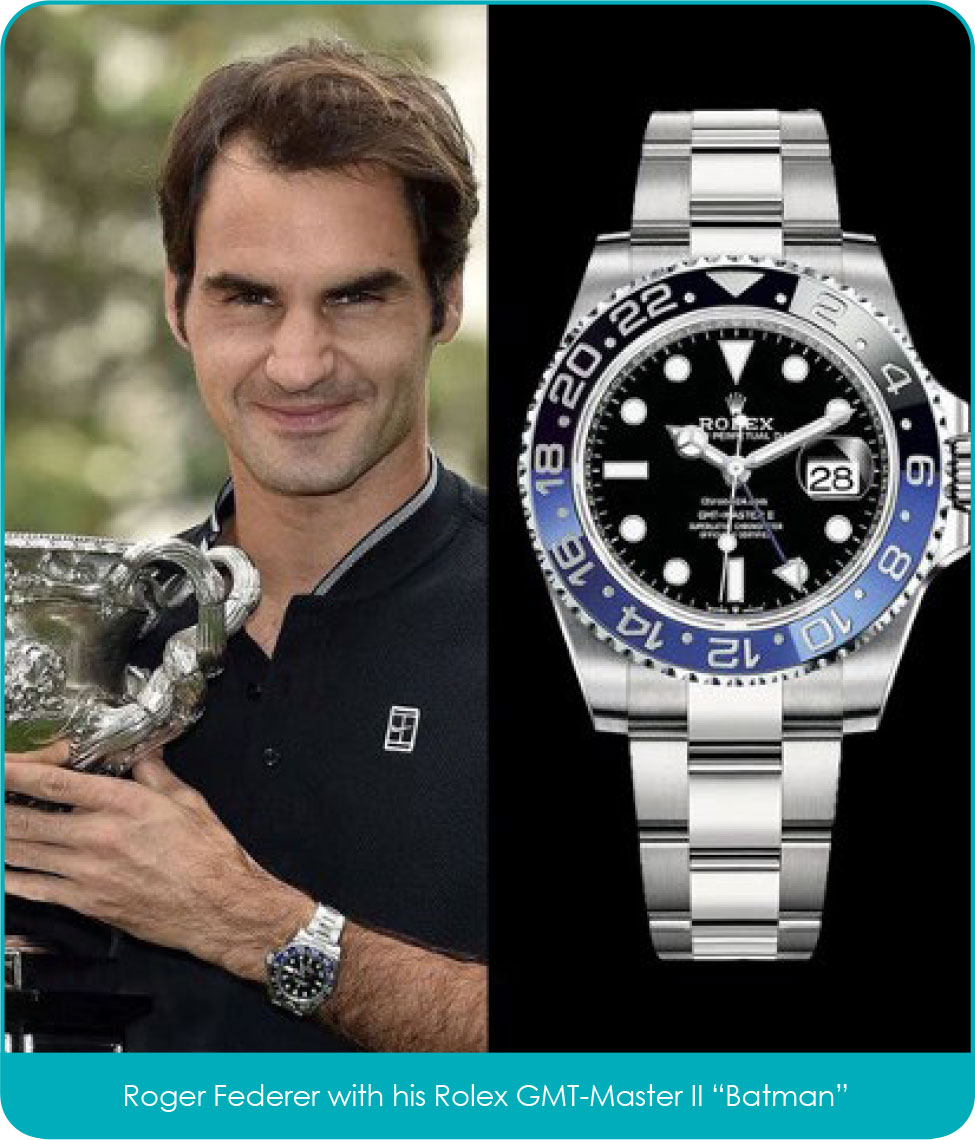

On the 28th, it always feel like dates have ceased to matter, so as a special reminder, this Rolex DateJust 1601 in stainless steel, selling for £4,400. Discreet and elegant, it is worn as jewellery.

On the 29th, perhaps a night out in a restaurant dreaming of that sky trip would require novelty cufflinks, as these enamel and silver cufflinks by Francis & Deakin, selling for £315.

On the 30th, one will have a quiet night in before the New Year celebrations. It could be a night to remember and remind that wonderful person just how much you love them with a fancy coloured-diamond ring from De Beers. The below cluster ring is set with a 0.52ct fancy yellow diamond, VS1, within a surround and shoulder set with brilliant-cut diamonds and retails for £7,250.

On the 31st, to celebrate the new year offered to us as a gift, one could purchase these vintage Chanel earrings for £1,370 decorated with bows, like a gift to unwrap.

2024 will be the year of the Dragon in Chinese culture. Dragons symbolise courage, power and protection.

Therefore, to start the year, on the 1st January, let us internalise all these elements and choose to wear a dragonset jewel such as the Fabergé Palais Tsarkoye Selo Red Locket with Dragon Surprise by Fabergé, retailing for £12,000.

The 2nd January calls for a quiet cuppa, and how best to accessorise than with Tea for Two bangle by Hermès £485, decorated with enamel.

On the 3rd, perhaps one is gifting the last few presents of the season and this trio of brooches would make a lovely addition to any jewellery collection, sold for only £280 at Dawsons Auctions a few days ago.

The list wouldn’t be complete without referring to The Princess of Wales jewellery. The Princess is one to reuse dresses and outfits so we could certainly get inspired by her look from last year with the goldplated earrings she wore last Christmas from Cezanne, retailing for £100. No one will notice they aren’t sapphires…!

Finally, as we look to the future and the warmer weather to come, on the 5th January I would recommend the mother-of-pearl Sweet Alhambra bracelet by Van Cleef & Arpels, retailing for £1,300. The butterfly motif reminds us that spring is not too far away, and with it the promise of longer days filled with possibilities…

All these gorgeous gifts bring us to a total of £32,855, well within our budget and enough to splurge on that meal, extra gift or trip away. Best Wishes to all.

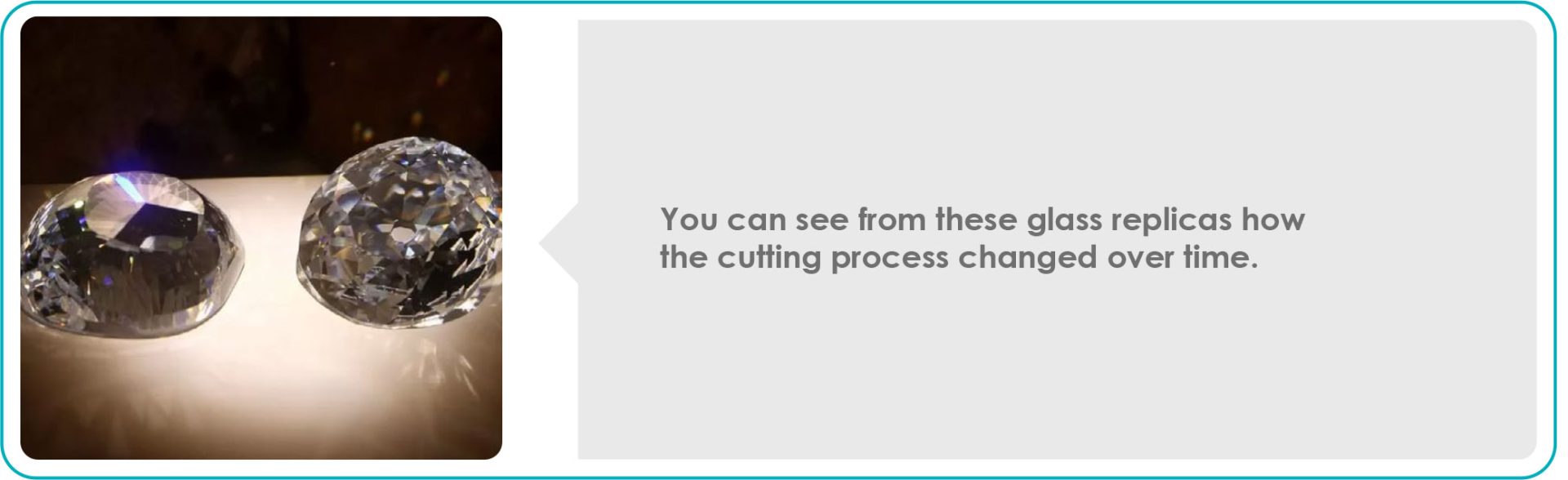

In the mid-15th Century cutters designed the table cut diamond, they used the same polishing methods and simply removed the top point of the octahedral shape to produce a table.

In the mid-15th Century cutters designed the table cut diamond, they used the same polishing methods and simply removed the top point of the octahedral shape to produce a table.

After developing and perfecting table and rose cuts, European cutters started to experiment with new cuts and styles. Cardinal Jules Mazarin requested that cutters in Europe designed a faceted diamond. The result was a cushion shaped diamond with 34 facets called the Mazarin cut, also known as the double cut.

After developing and perfecting table and rose cuts, European cutters started to experiment with new cuts and styles. Cardinal Jules Mazarin requested that cutters in Europe designed a faceted diamond. The result was a cushion shaped diamond with 34 facets called the Mazarin cut, also known as the double cut.

The mid-17th century saw the introduction of the single cuts. Like the point and table cut, the single cut resembled the shape of the octahedral rough. It also displayed more potential for brilliance than the table cut because it had more facets. This cut served as the basis for the modern brilliant cut and even today, the single cut is still used on smaller diamonds.

The mid-17th century saw the introduction of the single cuts. Like the point and table cut, the single cut resembled the shape of the octahedral rough. It also displayed more potential for brilliance than the table cut because it had more facets. This cut served as the basis for the modern brilliant cut and even today, the single cut is still used on smaller diamonds.

The new rough from Brazil was used to create the first old mine cut also known as the Peruzzi Cut; this has the same number of facets as the round brilliant, but with a high pavilion it resembles a cushion shape. In 1750, a London jeweller called the new style of cut a passing fad and said the classic rose cut would outlast them all.

The new rough from Brazil was used to create the first old mine cut also known as the Peruzzi Cut; this has the same number of facets as the round brilliant, but with a high pavilion it resembles a cushion shape. In 1750, a London jeweller called the new style of cut a passing fad and said the classic rose cut would outlast them all.