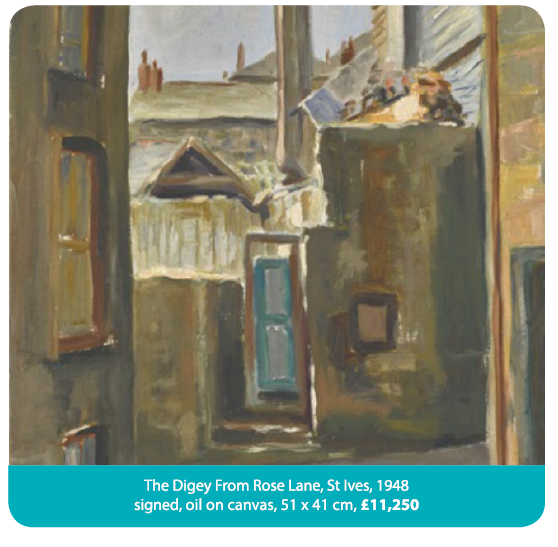

To be asked to write an article about one of my favourite artists is truly a delight. Sir Terry Frost’s muse wasn’t a person but the Cornish town of St Ives. Thanks to Covid this unique seaside town with all its artistic heritage, glorious light, sights and sounds of the sea, which was for so long an inspiration for Terry, is now the ‘go to’ vacation spot for families across the UK, so hopefully current and future generations will get to see for themselves just what inspired Terry and so many other great artists over the years.

Terry was born and brought up in Warwickshire, he left school at 14 and started work locally, working mostly manual jobs with no sense that his natural artistic ability would ever make him a living. When war came he served as a regular soldier, first in France then the Middle East and Greece before joining the Commandos. While serving with them in Crete in June 1941 he was captured and sent to various prisons for the duration of the war. During his time at Stalag 383 in Bavaria, he met the painter Adrian Heath who saw Terry’s talent and encouraged him to paint. Terry later described these years as ‘a tremendous spiritual experience’, he felt that he had gained ‘a more aware or heightened sense of perception during my semi starvation.’

As soon as the war was over, Terry went to study at the Birmingham College of Art, he soon discovered the action was in London and moved down to Camberwell School of Art. By 1946 he had removed to study at St Ives School of painting for one year where he held his first one man exhibition in 1947. He continued his studies in London and Cornwall and when in 1950 he was elected a member of the Penwith Society, he made a move to St Ives in 1951. He later taught at Leeds and in Cyprus and finally settled in Banbury, Oxfordshire in 1963.

In 1960, Frost held his first one-man show in New York at the Bertha Schaefer Gallery. This exhibition was a seminal moment in his career and he said of this experience:

‘In New York they all came to my exhibition, de Kooning, Rothko, Klein. Newman and Motherwell all took me to their studios.

I accepted it all as normal and they accepted me. They were all painters struggling to get somewhere like I was. They worked hard; they would sleep until noon, do eight or nine hours in the studio, and then starting at eleven at night proceeded to drink me under the table! Then we’d go out at four in the morning and have breakfast at a Chinese restaurant.’

I first met Terry in the 1980’s during my early days at Christie’s, I would see him either at our auction preview ‘Drinks’ or at his shows at the Whitford gallery just around the corner in Duke Street. He was always full of fun and told great stories such as this one from his days working in the 1950’s as an assistant to the sculptor Barbara Hepworth in her studios in St Ives … Hepworth was convinced her clients would not buy her work if they knew she didn’t make everything herself, so she was understandably nervous whenever prospective clients came to visit her studios. Terry told me that whenever visits took place he and the other assistants all went down to the pub until the coast was clear. One particular day important clients were coming so Terry and the other assistants made themselves scarce in the pub as usual, expecting on their return to find the visitors long gone. However as soon they arrived back Barbara told them to hide, the clients has arrived late and were still in the house and would be coming up the path any minute now. The assistants all managed to quickly find a hiding place and Barbara began showing the clients around the garden and studio. Terry was well hidden behind a bushy tree, however he could feel all the beer was beginning to well up inside him and very soon he was going to have to pee ! He hung on and on but with the tour continuing he could hold out no longer. He couldn’t risk nipping to the loo so performed the task from his bushy hiding place thinking he had got away with it. However unknown to Terry he had unwittingly created a small river which was running swiftly down the path towards Barbara and her prospective clients, Barbara noticed the stream but luckily her clients were too busy enjoying their tour to notice and Terry got an ‘earful’ from the boss after they had gone.

Terry’s many talents were fully recognised during his long career, he was made an R.A. in 1992 and Knighted in 1998. Speaking in the 1980’s about his work he said; ‘A shape is a shape, a flower is a flower.

A shape of red can contain as much content as the shape of a red flower. I don’t see why one should have to have any association, nostalgia or evocation of any kind. It boils down

to the value of the shape and the colour.’

Terry was always making art and exploring new avenues and mediums. I went to his last London show at the Whitford Gallery to see he had totally changed his medium and had made wonderfully colourful moulded and blown glass pieces. Forever energetic and full of new ideas, Terry Frost represents all that is good and great about late 20th century British Art.