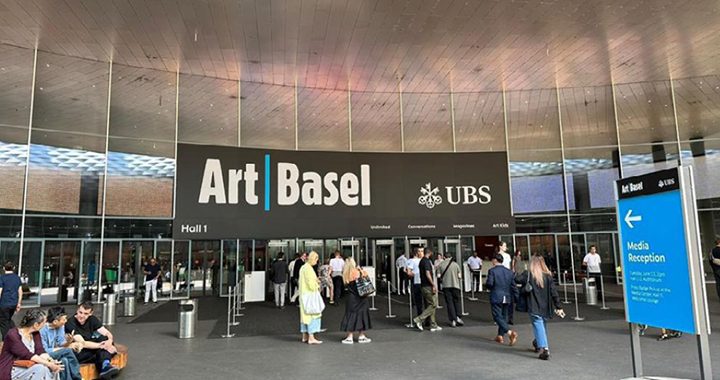

Last week’s Art Basel 2023 contemporary art fair, June 15 – June 18, defied forecasts of a market slowdown, with wealthy collectors buying works with seven or eight-figure price tags.

Described by its new chief executive Noah Horowitz as ‘the single most important annual event in the global art market’ and the ‘barometer of the industry’, Art Basel opened its doors to VIPs last Tuesday – the first two and a half days of the fair are traditionally reserved for wealthy collectors, before the doors open to the public from Thursday to Sunday.

Some 284 galleries representing more than 4,000 artists are represented at the fair in the Swiss city, which for one week every year becomes the centre of the global contemporary art market. Among them are regulars of the art event such as Gagosian, Hauser & Wirth, Pace, David Zwirner and Perrotin. Some 20 galleries from Europe, Africa, Asia and America will have a stand for the first time.

Three of the first-time labels are entering directly into the main Galleries sector, namely Blank projects (Cape Town), Empty Gallery (Hong Kong) and Offer Waterman (London). The Feature sector will host eight first-time exhibitors, including David Castillo (Miami), Thomas Erben Gallery (New York) and Gajah Gallery (Jakarta, Yogyakarta, Singapore), compared to 10 for the Statements sector.

Art Basel director Noah Horowitz hopes this year’s event helps maintain Art Basel’s status as the world’s leading contemporary art fair.

‘I am incredibly excited to welcome the international art community to Basel in June for another premier edition of our show and my first as the organization’s CEO,’ he said in a statement. ’Ranging from bold contemporary positions to rare presentations by 20th-century icons, our Basel fair will once again reaffirm its pre-eminent position as a platform for discovery and encounters that drive the art world.’

Alongside the contemporary art fair itself, visitors to Art Basel were able to discover some 20 special installations around Münsterplatz and downtown Basel.

One of these was a ‘sprawling superstructure’ designed by French-Moroccan artist Latifa Echakhch, a former Marcel-Duchamp Prize winner and Switzerland’s representative at the Venice Biennale in 2022. In addition, the city’s museums and cultural centres offered a wide range of exhibitions and events throughout the week.

While stock markets jitters and soaring interest rates had triggered predictions that the art market was cooling, that was not evident at the fair, where it was reported by Marc Glimcher, CEO of Pace NY ‘the art market seems quite healthy here in Basel. People are not paying crazy high prices, but they are not asking us to sell at crazy low prices either.’

At its VIP Day last Tuesday, Zurich’s Hauser & Wirth confirmed that they had sold a major 1996 spider sculpture by Louise Bourgeois to a US collector for US$22.5m (the most expensive sale of the day), and also an oil on canvas by US painter Philippe Guston for US$9.5m.

Similarly, New York’s Pace Gallery sold two fox sculptures from a new series by US artist Jeff Koons, even though one of the works had yet to be finished. They went for US$3m each. They also sold a Alexander Calder mobile for $2.8m and two smaller works by the artist, offered by his family, for $775,000 and $675,000. David Zwirner exhibited and sold Gerhard Richter’s oversized 2023 sculpture STRIP TOWER for $2.5m. Blue-chip work on the primary market that sold on VIP Day included a new painting by Jonas Wood, offered by David Kordansky Gallery for $2.5m.

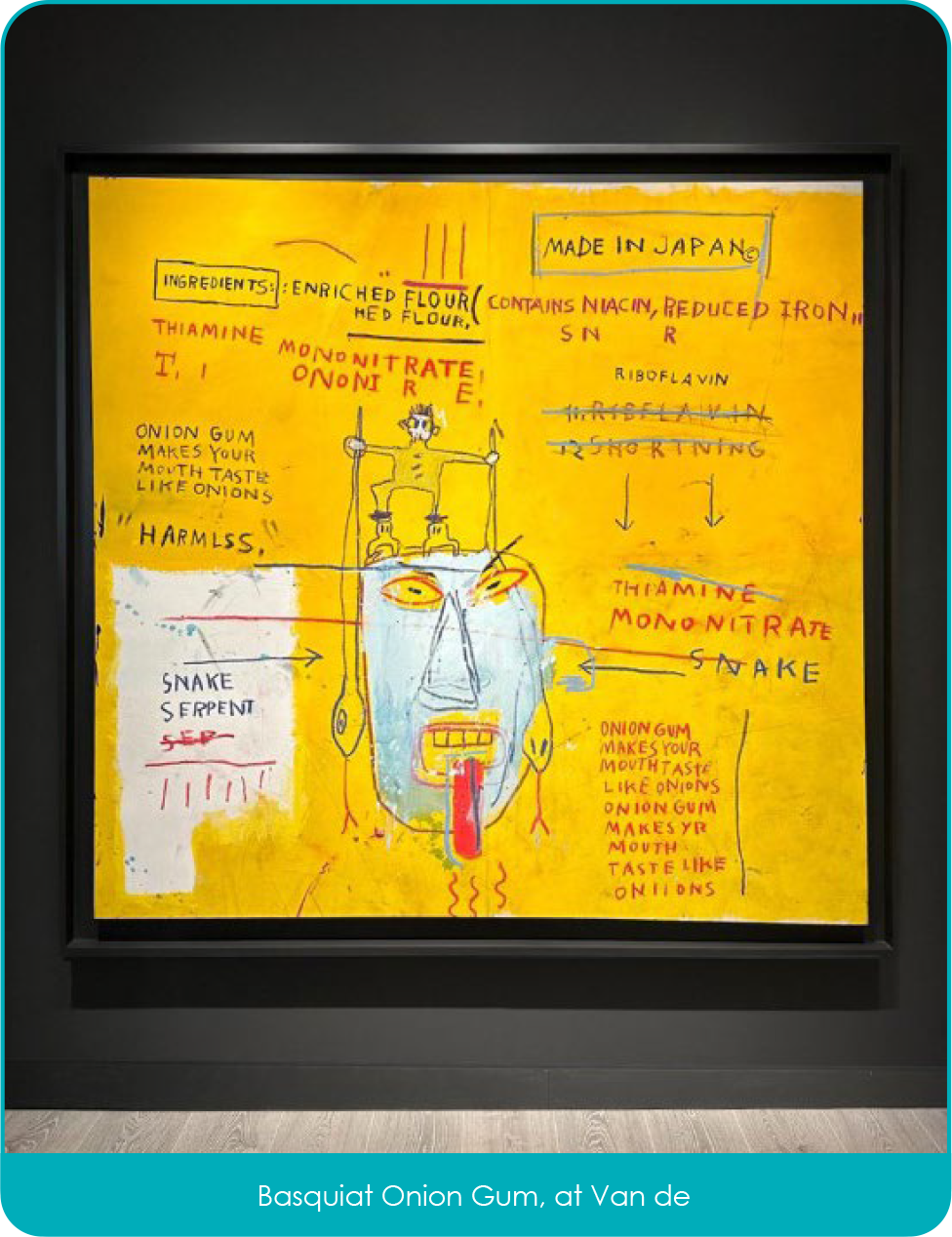

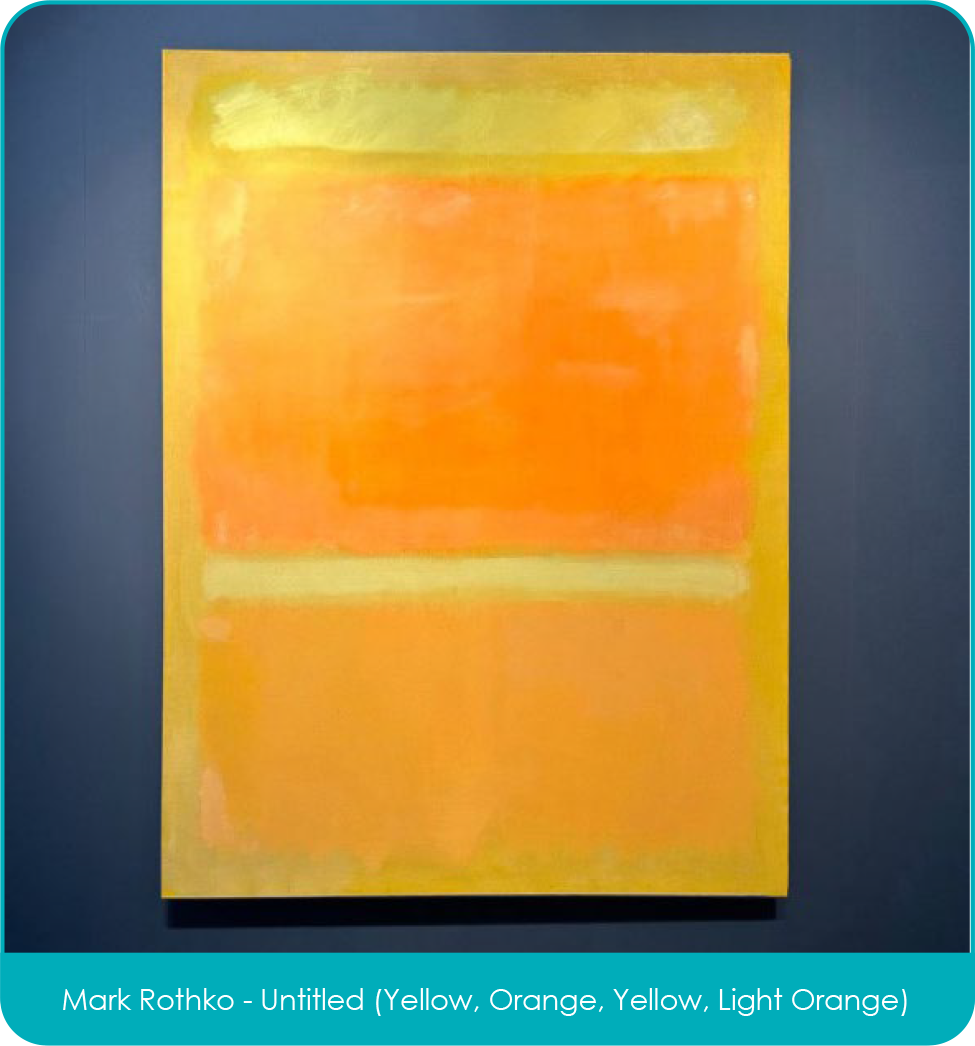

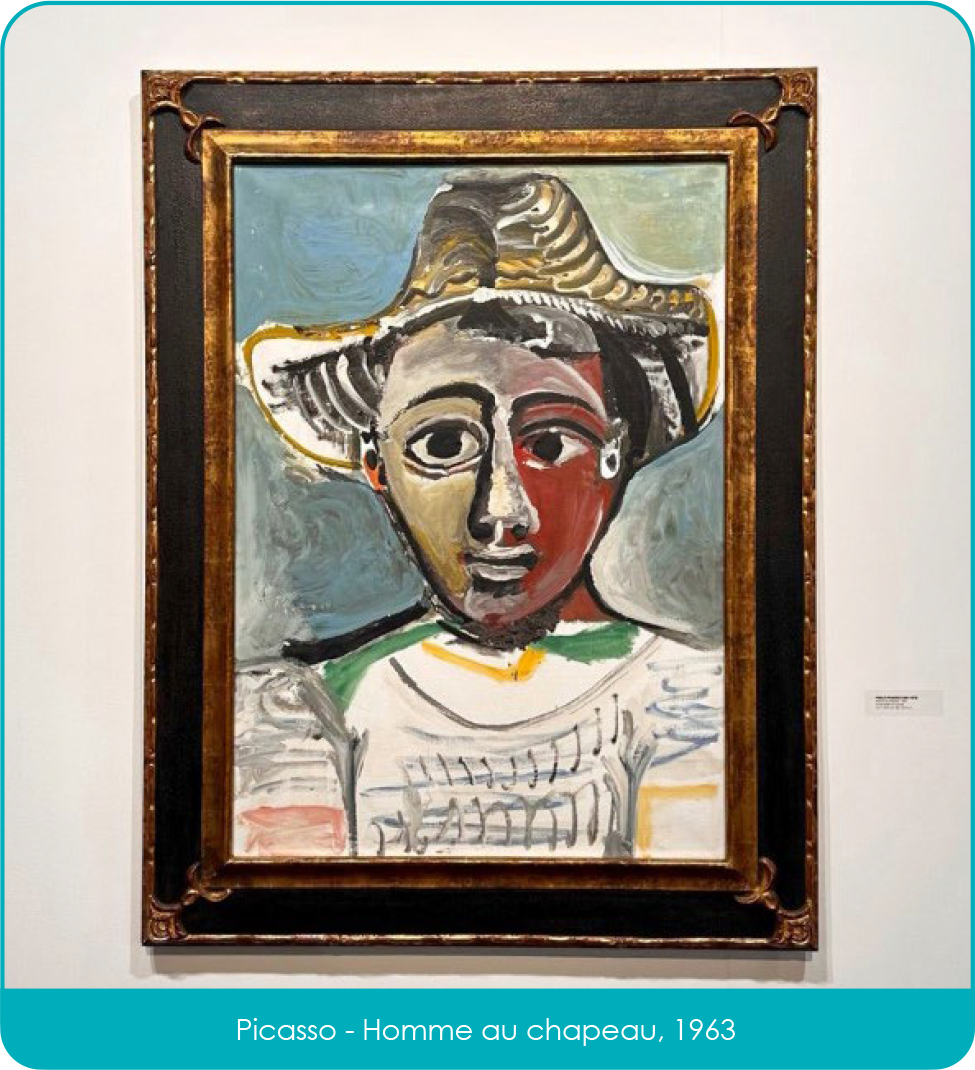

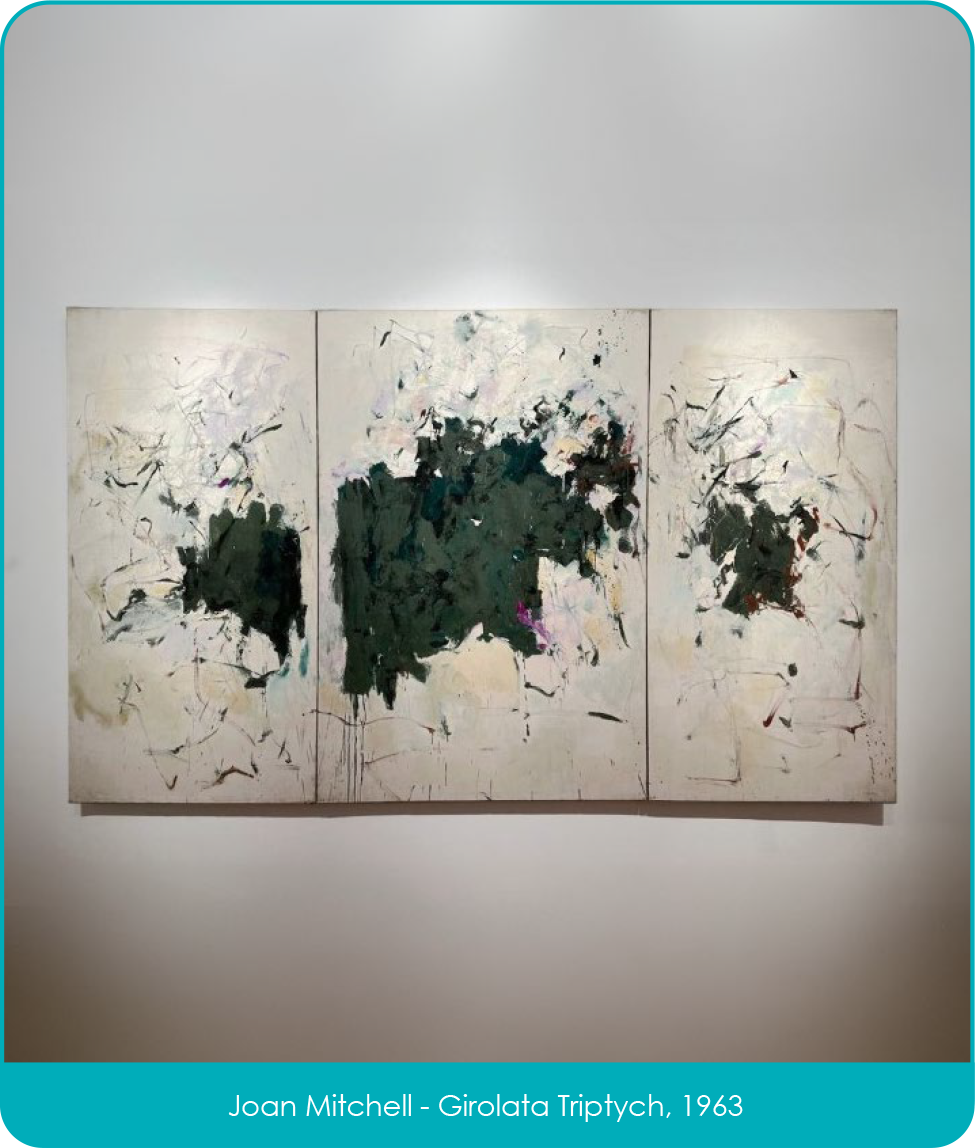

Other highlights to be seen at the fair included a gorgeous sunset collured Rothko painting offered at $60m by Acquavalla Galleries; an impressive Picasso for $25m at Landau and a $14m Joan Mitchell triptych at Pace.

After a healthy rebound in 2021, the art market grew three percent in 2022 to US$67.8b, according to Art Basel’s annual art report published by Clare McAndrew.

McAndrew writes that while the first half of 2022 was marked by strong sales, and a number of record prices, the market was more subdued in the latter half due to political and economic instability, the war in Ukraine, increasing inflation rates, supply issues and looming recessions in key markets.

Whilst the Art Market is almost certainly cooling, this is a necessary correction that happens in the market every now and again. The market is still buoyant, with good things selling, but buyers are simply not paying over inflated prices. As art dealer David Nolan reported, ‘tricky times are often prime opportunities to buy art, with galleries more amenable to discounts and collectors looking to free up capital. There is such diversity in the types of people who come to Basel, many of whom budget specifically to buy at Art Basel, and who are less affected by the stock market and the interest rate fluctuations.’

Ben is an established contemporary art specialist. He began his career working in the Old Master and 20th Century markets before moving into the contemporary market. He has over 20 years’ experience working in the UK and international art markets.