In the same way that ‘location, location, location’ has historically underpinned great property investment, ‘quality, quality, quality’ has always lain at the heart of great art collecting. The strength of this strategy of only buying the very best proven crystal clear with the spectacular results achieved by the recent auction of the art collection amassed by the late Microsoft co-founder, Paul Allen’s at Christie’s.

Split in two parts – Visionary: The Paul G. Allen Art Collection, was provocatively billed by Christie’s in their pre-sale marketing, ‘to be the largest and most exceptional art auction in history’, with predications that it would surpass $1 billion in sales for the first time in history, beating the $922.2m realised last by Sotheby’s in May last year’s Macklowe Collection.

Christie’s predictions turned out to be both true and conservative – Part I of the collection on 9th November saw 60 extraordinary works achieve a total of $1,506,386,000, with five paintings achieving prices above $100 million. The works in the sale sold 100 per cent by lot with 65 per cent of the lots selling above their high estimates. Part II of the collection on 10th November, went on to achieve an additional $115,863,500 for the remaining 95 works offered for sale. In total, the proceeds for the landmark series of sales, totalled and an extraordinary and ground-breaking $1,622,249,500 – all of which is being donated to the various charitable causes Paul Allen established and supported during his lifetime.

What makes the Allen collection so extraordinary, aside from the huge numbers attached to it, is that the collection was put together entirely by Allen himself in less than 30 years. The fact that a collection of such quality and size can still be amassed today, with so many masterworks being in museum collections and out of commercial circulation, is remarkable.

The scope of Allen’s collection is unusual in that it spanned more than 500 years, from Botticelli to Monet, from Picasso to Stella, from Seurat to Hockney. This breadth and variety of collecting is increasingly rare in today’s world, when most collectors tend to focus on a specific area of interest or particular artists, and develop collections which, although important, are more limited in their reach. Paul Allen’s collection and his method of collecting harks back to the height of American collecting in the late 19th and early 20th centuries when legendary collectors such as Frick, Rockefeller and Getty scoured the world for masterpieces across all genre and eras – the only prerequisite being quality. This type of collecting is a truly American phenomenon and demonstrates that when there is the rare combination of ambition, taste and limitless money, great things can happen.

What sets the Paul Allen Collection apart from others is the also fact that Allen himself oversaw each and every purchase himself, without the help of the ubiquitous art advisor who is the mainstay of most billionaire collectors. This personal engagement in the collection, reflects Allen’s strong interest in world culture and history, and gives the collection a personality which only great collections possess. As Paul Allen said, “When you look at a painting you’re looking into a different country, into someone else’s imagination, how they saw it.”

It was a given that such an extraordinary collection was always going to achieve extraordinary things when offered at auction – since the market is avaricious for works of this level. Christie’s performed their part superbly, and ran a slick international marketing campaign that promoted the collection worldwide. The results were stupendous.

The highest price achieved in the sale was for Georges Seurat’s 1888 Pointillist masterpiece, Les Poseuses, Ensemble (Petite version), which made $149.2m and smashed the previous Seurat world record by a multiple of four. The world icon is used far too often in modern parlance, but in this case, the word is truly deserved.

Similarly, Paul Cézanne’s 1880-1890 La Montagne Sainte-Victoire – a classic rendering of Cézanne’s most iconic of subjects – also smashed the $100m barrier, achieving $137.8m; and Gustav Klimt’s 1903 painting, Birch Forest, set a world record for a Klimt, selling for $104.6m.

Other notable sales included the highest price ever for a van Gogh painting, Verger avec cyprès, which sold for $117.2m. Paul Gauguin’s 1899, Maternité II made $105.7m, and Lucien Freud’s masterful portrait, Large Interior WII (after Watteau), made $86,265,000.

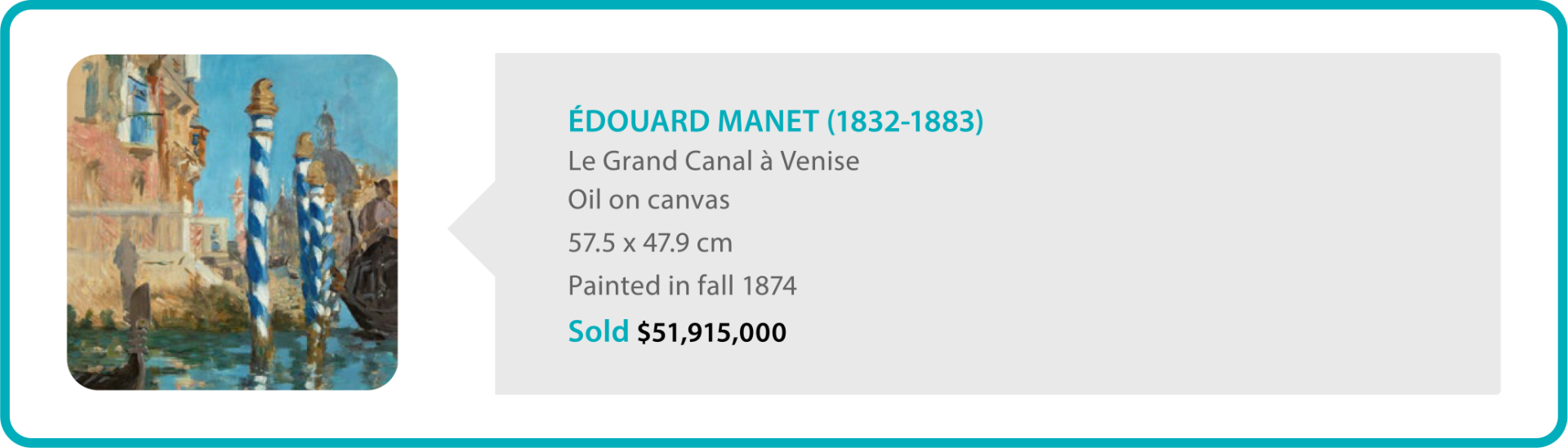

Further paintings by Éduard Manet, Pablo Picasso, David Hockney, Andrew Wyeth, and Georgia O’Keeffe, all went onto achieve strong prices, alongside sculptures by Alberto Giacometti, Alexander Calder and Max Ernst.

In contrast to these masterpieces of Impressionist and Modern Art, the collection also featured a number of significant old master paintings – most notably, Sandro Botticelli’s exquisite, Madonna of the Magnificat, which sold for a ‘relatively’ affordable $48,480,000m, when one considers the rarity of fully autograph works by Botticelli on the market.

One work, Lot 131, demonstrates to me more than any other work, the personal nature of the collection, and the discerning eye of the Paul Allen himself. It also happens to be the most modest work offered for sale. Measuring only 21cm high, it is an exquisite but fragmented Renaissance sculpture showing clasped hands of the Virgin Mary, catalogued as Circle of Donatello. The fact that a man such as Allen, who could afford any masterpiece in the world, was also drawn to such an exquisite but unassuming work, indicates the level of his sophistication, and proves that quality, should lead a collector when buying a work. The market agreed, and the little gem made 26 times its lower estimate and made $252,000.

Ben is an established contemporary art specialist. He began his career working in the Old Master and 20th Century markets before moving into the contemporary market. He has over 20 years’ experience working in the UK and international art markets.