Finally, this month will see the release of the much anticipated ‘No Time to Die’ – the 25th film in the James Bond series, despite a very long wait since the original release date the world is waiting to see just what Bond can offer in Daniel Craig’s last outing as 007.

It is a phenomenon that in 2021, a character such as Bond can still pull the crowds, but it’s the franchise that always wins and whatever is associated with Bond generally brings in the royalties as well. With a supposed birthday of the 11th of November 1920, he is certainly looking good for his age…

How though, has Bond changed over the years? In 1962 when ‘Dr. No’ was released, it’s doubtful that anyone could have seen just what effect the Scottish/Swiss secret agent (who was named after an expert on American birds, and one of Ian Fleming’s favourite authors) would have on films, products and computer games to name but a few.

Now, what a lot of people don’t realise is that Bond’s car was a Bentley – according to Ian Fleming – the Aston Martin came with the films, but the DB5 is now possibly the most recognisable movie car on the planet, possibly more recognisable than some of the lesser-known Bond actors (sorry, Timothy). Strangely, the most expensive example of this legend is a Bond car, but not as one might imagine. The promotional car for ‘Goldfinger’ (1964) sold a couple of years ago for close to £5,000,000 and was in remarkable condition as Mr Connery had never driven it in anger during production. To put it in context a standard DB5, minus ejector seat and oil slick jets, can be purchased for under a million.

For those with a lesser budget, my choice would always be the Alfa Romeo GTV6 driven by Roger Moore in Octopussy – obviously this was a prop car as when I owned one of these, saving the world from nuclear destruction would not have been on my agenda – just getting it to start was considered a success.

Bond’s watches are another example of how one man (and maybe a great marketing department) can change the course of a product. So, what was the first ever Bond watch on screen? It was the instantly forgettable Gruen Precision 510 (Connery’s personal watch, and worn in many other Bond outings)… but nobody cares about that and so we always talk about the Rolex Submariner 6538.

Again, the source of the watch was reputably Connery, although it has been hinted that it may have belong to production staff… with the passing of Connery, I suppose we will never get the full lowdown… what is true however is the escalating value of the 6538 along with most other vintage Rolex sports models. If you want to` be a part of the ‘Big Crown’ Rolex club, be ready to hand over close to £100,000 for a good one these days.

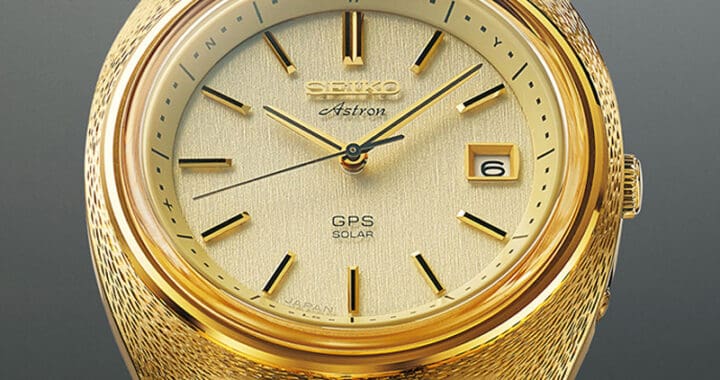

There are of course, again many other options for classic Bond watches, with Seiko, Breitling and most recently Omega, whom have pretty much rejuvenated a brand tanks to Pierce Brosnan, and Daniel Craig wearing some timepieces that do far, far more than tell the time.

When we look at the clothes that Bond sports, there has always been that sartorial elegance with Bond, with Daniel Craig wearing a symphony of Tom Ford attire, with accoutrements by Sunspel, Orlebar Brown and many others but, for me nothing beats Roger Moore in the Safari Suit though, capturing a moment when being a secret agent required a pair of flared trousers, and preferably with a silk cravat.

So, over the years – many things have changed with Bond from watches, to cars, and clothing manufacturers. Hopefully, ‘No Time to Die’ will be as good as we have come to expect from 007, as nobody does it better…