If, like me you, didn’t get the opportunity to visit the hallowed grounds of Wimbledon this year, I hope you enjoyed the coverage provided on the television. What you may have noticed is that a lot of the images you will have seen at home not only presented a lot of great tennis, but also a lot of celebrities in the royal box – whether or not seeing Hugh Grant taking a quick cat nap is as entertaining as some of the games of this year is debatable. What can’t be denied is the sheer wealth of impressive watches that we saw – some of them completely expected and some nice surprises.

The Princess of Wales – Cartier Ballon Bleu

The Ballon Bleu is quickly becoming her fashion staple, and why not – it’s the perfect size at 33mm and has all the traits of style and understated elegance. Currently retailing for around £6,000, it’s a great watch for all seasons and is as comfortable on centre court at Wimbledon as it is in Annabel’s on a Friday night.

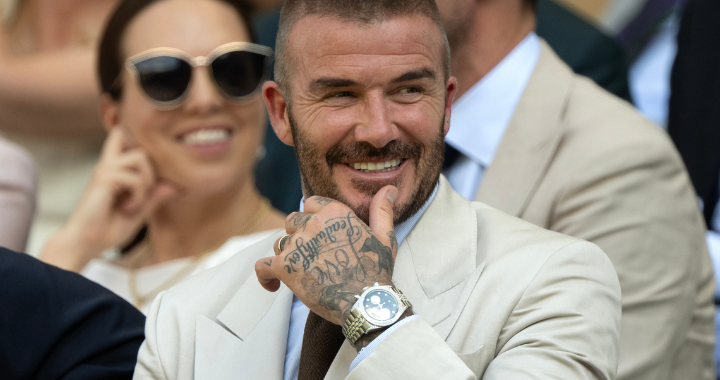

David Beckham – Tudor Black Bay Chronograph Custom

Well, he wasn’t going to wear a , was he?

Possibly the most talked about watch of this year was an item given as a present from Tudor to celebrate Sir (can we say that yet?) Dave’s 50th birthday. It’s a dramatic piece with enough diamonds for a royal tiara, but still, in a David Beckham way has a little bit of subtlety to it. You can’t buy one, so any figure would by hypothetical but given its provenance it’s going to be insured for north of £200,000.

Roger Federer and Leonardo DiCaprio – Rolex Land Dweller

I am fairly sure that everyone around Wimbledon was expecting the eight time Wimbledon champion to be wearing a Rolex, and of course he didn’t disappoint. The arguably greatest man to ever play the game (of course this is very debatable) arrived with the new kid on the block, the Land Dweller. Whilst it may sound like the name that a Korean car manufacturer might give to their new SUV, it’s actually a pretty stylish piece of work, just don’t mention the Tissot PRX….

Leonardo DiCaprio also entered Centre Court with the same watch, whilst dressed fairly casually, it proved a point that the Land Dweller can be worn up or down, much in the same way that the ever popular Datejust can. Currently, you have a slightly lower chance of getting hold of a Land Dweller than you do getting said royal box tickets for the men’s final, meaning that the £13,000 (model no.127334) will currently set you back close to £45,000 on the secondary market, which is not surprising.

Russell Crowe – Rolex Daytona Tiffany Dial, AKA – Maximus Blingiest Rolexus

Who would have thought that a turquoise dial with gold case would work anywhere outside of a Swatch launch party, but it does…

On an Oysterflex strap it gives a strange sense of sportiness and refinement that continues the legacy of the Daytona into areas where it has never been before. In typical Rolex style, the chances of owning one of these are less than surviving in the Colosseum, so you will currently pay north of £75,000 to get your hands on one, despite having a retail price of less than half that.

Eddie Redmayne – Omega Seamaster Aqua Terra Shades

We couldn’t talk about the watches of this year without mentioning an Omega, a genuinely brilliant brand with all the performance, all the technology, and all the style of its main competitor, just without the Instagram tags and mugging statistics. The ‘Day of The Jackal’ star arrived in a suitably smart cream suit, which really should have been accompanied by a nice cravat – but alas. With a red dial, this Omega steps away from its conservative approach but still gives a nice subtle vibe. As with most Omega watches, you can actually buy this one – with a price of £7,000, it’s not cheap but a lovely thing that will match your strawberries at Wimbledon – if you would risk it in a suit that colour.

Of course, there were many other watches on display – notable mentions include Chris Hemsworth in the Audemars Piguet Royal Oak Double Balance Wheel, which not only sounds like a piece of gym equipment from school, it’s actually the same size too.

Tom Holland wore an Ice blue dial Daytona, which as one of the stars of the 2022 boom, peaked at well into the six figures, but thankfully now is slightly more accessible at just under £100,000 (I did say slightly).

What this year did show is that as well as a fashion show, it’s also a great opportunity for the great and the good to show what they have in the watch box, or what they may have been given at the hotel the night before from a brand representative.

No doubt next year will bring more interesting watches, and hopefully a slightly longer women’s final.