The Early Days of Cartier

In 1847 Louis-Francois Cartier takes over a studio in Paris, joined by his son Alfred, and later by his three grandsons, Louis, Pierre and Jacques. Within a decade their reputation precedes them and they provide jewellery to the Empress and Napoleon’s extended family.

The years 1910-1940 are considered by many experts to be the golden era for Cartier. It employed the finest designers and craftsmen, but not necessarily jewellery designers. They preferred to hire designers from all backgrounds: furniture designers and architects to get a fresh pair of eyes on jewellery design.

During the early 20th century, peace rules and the Exposition Universelle of April 1900 attracts over 50 million guests in 7 months. The Ritz opened its doors in 1898. It is overall a prosperous time during which Cartier move into their new quarters in the luxurious rue de la Paix, in Paris. From then, everything takes off. They have international purchasers, organise exhibitions abroad such as in St Petersburg to showcase exceptional pieces inspired by Easter and Christmas. When they officially open their new atelier (“shop”) rue de la Paix, they combine it with launching a new technique of jewellery making: setting stones and jewels into platinum all the while keeping the traditional style.

It was the beginning of a revolution yet to come in jewellery design and making.

The Beginnings of the Art Deco Movement

It’s generally agreed that the 1925 Exposition Internationale des Arts Décoratifs et Industriels Modernes in Paris was the official launch of the Art Deco movement, though the style can be traced back at least a decade before.

The Great War is the catalyst for the movement to emerge. Women, having done men’s jobs during the war, come out of the shadow and step away from the delicate and fragile attire of the Belle Epoque era with bows, ribbons, swags, flowers, items mounted en-tremblant. From now on, angular stones, baguette and calibré-cut diamonds are favoured along with short hair “à la garçonne” (“like a boy”) and suits, giving women a masculine but sexy look.

Cartier Tank Original 1919

Art Deco was Synonymous with Freedom and Order

Launched in 1917, created by Louis Cartier and inspired by chaos, comes the Tank Original. This first wristwatch is rectangular, has a creamy-white dial which offsets the bold Roman numerals, chemin de fer chapter ring, with blue steel sword-shaped hands and a sapphire cabochon winder. The prototype was presented to General John Pershing of the American Expeditionary Force by Cartier himself and has become a symbol of chic and luxury.

It is a clear step away from the curves and fussiness of Art Nouveau with clear lines and no frills.

Louis Cartier, supposedly, was inspired by Renault F-17 tanks as seen from above: the brancards representing the tracks of the tank and the square case its main housing.

The wristwatch is a real symbol of freedom. No longer attached to your attire, there is freedom of movement in the wrist. It resonates the desire for structure in the midst of chaos, it celebrates technology and new machinery.

Art Deco Jewellery Echoes New Clothes and Hair Fashion

In jewellery, the Edwardian and Belle Epoque style are no longer accepted. Heavy tiaras are replaced with head pieces called bandeau.

Queen mother wearing a Cartier bandeau made up of three of the five bracelets which her husband, King George VI bought for her.

A diamond bandeau by Cartier sold by Christie’s in November 2019 for almost £900,000.

Some more “modest” bandeau would have been set with tarlatan and beads rather than diamonds. Or if jewellery was adorned with diamonds, smaller sized diamonds and gems were used, breaking from the past which favoured very large stones. Pieces were now set with detailed calibré-cut stones, meaning they are usually square or rectangle and cut to fit a piece.

The Art Deco head pieces were light and had straight lines rather than garlands found in Belle Epoque jewellery for example. It fits short hair and with that comes longer earrings for example and sautoir (long necklaces).

A Cartier pearl and diamond sautoir, circa 1925, sold at Christie’s in May 2012. Estimate £60,000-85,000 sold for approx. £400,000

Pearls are an important component for Cartier and were a sure thing to buy, until the Wall Street crash in 1929.

Monochrome Art Deco

In the earlier years of Art Deco jewellery, pieces were monochrome, black and white were key. Using rock crystal, onyx and diamonds as key gems. In the wake of the Great War, many were in mourning.

A diamond and rock crystal bangle, sold at Christie’s for $204,000 in Oct 2000.

This price reflects the constant desire for the sleek sober but luxurious look of Art Deco monochrome pieces, a style always in vogue and not likely to disappear anytime soon.

Vogue states that “A woman, in Paris, who knows how to dress, is almost always dressed in black. Not through laziness but by sophistication.”

The Move to New Materials and Daring Combinations

As we move forward so does the colour scheme in jewellery. Cartier attempts daring combinations of colours which no one had previously tried. There are two factors which contribute to this new direction. In the Cartier archives, we find that Leon Bakst, a Russian painter and costume designer, and part of the Ballets Russes, was a great source of inspiration for Charles Jacqueau, one of the great designers for Cartier from 1909 until 1954. Leon Bakst had designed costumes for a ballet, Scherehazade, mixing only blues, greens and red. This had a big impact on Jacqueau. This colour combination had always been considered to be of bad taste until Jacqueau decided to take a risk and integrate it in his jewellery designs. Simultaneously, the discovery of Tutankhamun’s tomb in 1922 created waves in the Cartier design. Louis Cartier pushes his designers to familiarise themselves with all things Egyptian: heading to the Louvre to study their collection or simply walking through Paris, filled with Egyptian artefacts, to understand the style. Never before had anyone combined carnelian with turquoise and lapis lazuli, until now.

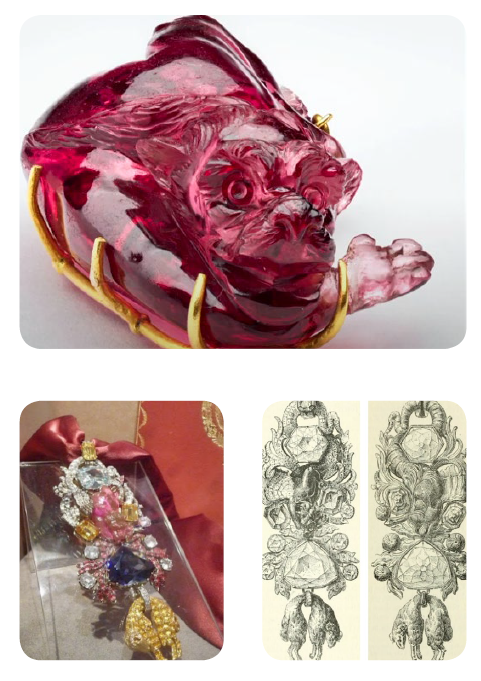

Renewed interest in Asian art meant that jade, lacquer, coral and enamel were also integrated. At this time, Jacques Cartier, who was running Cartier London, often travelled, and would return with many exquisite gems to be added to the Cartier jewels. These stones could be carved or made into cabochon. Cartier was the first to create these new colour and gem combinations. In the 1970s the style was named Tutti Frutti.

Contrast and Colour comes into Vogue

The Collier Hindou

Fransesca Cartier Brickell speaks about this necklace in her book “The untold story of the family behind the jewellery empire, The Cartiers”. The necklace belonged to Daisy Fellowes, the heiress to the Singer sewing machine. She had this necklace commissioned, using her own stones. It was designed to be tied at the back with a black silk cord, as would Indian jewels be. However, the big difference here is the use of sapphire, thought to bring bad luck in India. This is a statement of combining far away travels and traditional Western European gems. His daughter, the Comtesse of Casteja, inherited the necklace and in 1991 it was sold at Sotheby’s for $2,655,172. It was a world record for an Art Deco piece of jewellery sold at auction.

The Constant Desire for Exceptional Jewels

Tutti Frutti ruby, sapphire, emerald, diamond and enamel bracelet, by Cartier, circa 1930

The meandering vines, set with carved rubies, emeralds, sapphires, calibré-cut onyx, black enamel and diamonds is the perfect marriage of West meets East, a perfect artful arrangement. It belonged to an American family and had been in the family for 30 years. It came up for sale at Sotheby’s on 28th April 2020, during the pandemic. It was presented online only, during a four-day sale, during which five bidders competed to purchase the bracelet. Its estimate was $600-800,000 and sold for $1,340,000. It has become a record for any jewel sold in an online-only auction and any jewel sold at auction in 2020. Sotheby’s stated that it “follows a trend observed across all our global jewellery auctions in 2019 in which more than half of the jewellery buyers place their bids online.” This bracelet also illustrates that demand for such exceptional jewels, even during the most challenging times, will always exist. Cartier’s exceptional savoir-faire is timeless.