Why do people buy luxury timepieces? It is a question that many people will ask, but nobody can truly reply with one answer.

Is it to tell the time? Highly unlikely.

Is it a status symbol? Possibly.

Is it to stand out from the crowd? Again, quite possibly.

This is where the allure of a limited edition watch comes into play, lets picture the scene;

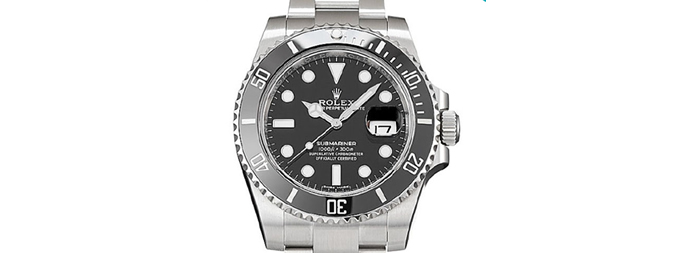

You are in your local bar on a Thursday evening (for those that work in London, you will know that this is the post covid night to be seen outside a bar in your gilet and trainers) and every other person in your office has a Submariner, or a GMT…when you arrive with a brand new limited edition watch that catches everyone’s eye. Irregardless of cost, the words that come out your mouth will be;

“Well, they only made 25 of these – and my authorised dealer managed to get me to the front of the queue”

In that very instant you will be launched into the higher echelons of the watch enthusiasts in your office, and demand respect among the other ‘watch guys’ who took the ‘obviously boring route’ into luxury watch ownership by buying a black bezel Submariner.

What is very clear though is that limited edition watches are actually almost an addiction for the hardened watch collector, the possibility of owning a watch that you are very unlikely to see another one of, apart at watch collectors evenings (yes, these things do exist) has such an appeal that many limited editions will be sold out months and years before they ever see the light of day.

So, why do limited edition watches even exist?

There are many schools of thought in this department and originally, they were formed in order to move old stock – the old adage of ‘How do you make something old more interesting?’ – by making it appear new again. Car manufacturers still use this trick by giving a tired old model that nobody wants to buy any more by putting in some new seats and a slightly different paint job.

Are they a good investment?

Well, given the date of October 2024, they are still a good investment but given the recent cycle of insane watch prices, it’s hard to determine where things might go but if we take one of the most noticeable and ‘mainstream’ limited editions and use this as an example.

The Rolex Submariner 50th Anniversary 16610LV

The Rolex Submariner 50th Anniversary 16610LV

What on earth is that I hear you cry – well like many iconic things on the planet, such as Plato, Voltaire, and Shakira, it goes by a simple one word name of (the) Kermit.

When this watch was released in 2003 it caused a minor stir amongst Rolex aficionados and remember that this was a time when you could consider buying a Rolex after seeing it, as opposed to just being told about it on the phone or email.

The green bezel was not considered to be in keeping with the Rolex ethos, despite the fact that all their boxes were this colour, and nobody considered that the GMT was a little too outlandish – and so this watch was discontinued in 2010, a mere 7 year run, which at the time was considered to be a major failure. Back then I was offered two of this model, with a discount on retail price of £500 a watch, roll on 14 years and the story is very different.

This watch still retails on the secondary market for around £14,000 – I am aware that at the absolute peak of the market some people were paying up to £21,000 for them, but that was ridiculous, as was most of the market around this period.

When compared to a standard black bezel that you will see 35 of every night at The Ned, it has performed better due to its limited run – so much so that Rolex released similar watches following this such as ‘The Starbucks’ and ‘The Hulk’ – FYI, Rolex don’t actually come up with this names, thankfully.

Patek Phillipe Nautilus 5711 40th anniversary

Whether or not this could be considered a ‘Limited Edition’ or not, is a good question – by any definition all luxury watches are ‘limited’ purely down to the fact that creating and manufacturing processes dictate that they cannot pull one off a production line every 30 seconds, considering that Rolex makes around a million watches a year, one could debate if this is down to supply to market rather than ability.

Another very good example of how the smallest detail can change not only the appearance of a watch, but also the heart rate of the collector is the Patek Phillipe Nautilus 5711 40th anniversary. From any distance this watch just looks like a standard 5711, (currently riding high in the top ten of the stockbroker mugging chart) but in fact it’s made from platinum and has an extra detail on the dial to indicate that you are very special, so special in fact that you were allowed to buy this watch. These small details now will tell the great and good that not only did you buy a Nautilus, but you also probably had to have owned a few in order to own this one – and now have to insure this particular watch for around £300,000.

Audemars Piguet Royal Oak Selfwinding Frosted Gold “Carolina Bucci” Limited Edition 37mm

There are many other watches that are released as ‘Limited Editions’ by the big boys in the horology world and they vary as much as anything else in terms of investment – one simply cannot tell until the market decides, and this means taking the plunge sometimes.

Whether or not history will be kind to the pink dial Tudor Chronograph is a question I have been asked quite a lot, needless to say – I have been diplomatic in most of my conversations about it.

Even in the sales pitch from Tudor, they say ‘It might not be for everyone’…but because it’s a limited edition, you should buy it anyway.

Why pink you may ask, but it’s actually a fairly simple answer – David Beckham. As one of the brands main ambassadors, and staple signature of masculinity, a pink dialled watch to go with his pink shirted football team Inter Miami seems to make sense in the celebrity endorsed watch world. For a price of £4,880, it does seem to be a reasonable outlay if you can live with that dial.

Tudor Black Bay Chrono Pink

Contact us about a watch valuation by emailing [email protected] or call us on 01883 722736.