As a general valuer, I still find it remarkable that the most shut off and private room of the house, is usually the one that hides the biggest mistakes, faux pas, successes, lucky finds – and ultimately valuable items in the property.

The humble wardrobe has for years been the item that comes last in a hierarchy of importance throughout the home – after paintings, sculpture and antiques it would almost seem vulgar to add up those collections of cashmere jumpers and boxed sets of Agent Provocateur underwear that you haven’t quite found the right time for.

So why is the wardrobe often overlooked? One could argue that accumulation plays a big part in this – if a client spends £2000 on a coat, would they contact their broker? Maybe not, but after five years of a new winter warmer every year, that figure starts to rise rapidly…also clothing just being a functional item went out in The Stone Age, clothes have been about style, exclusivity, and quality for centuries and that has created a fairly modern phenomenon – the clothes collector.

Whilst we all have items in the closet that hardly ever get used (for me it is a pair of trainers, used exclusively from January 1st – 7th annually, and a rather ill-advised pale blue suit bought for a garden party in the mid noughties) there are clients of mine that seasonally will spend over £100,000 on clothing and it will only be worn once or twice – this isn’t unusual, and strangely it seems to be becoming more common.

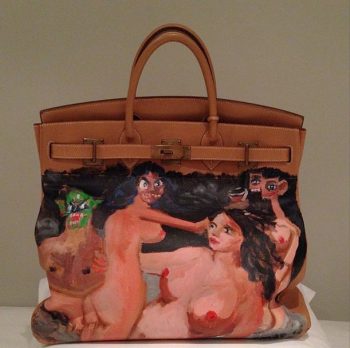

If you haven’t read my previous article on Birkin handbags, please do – it will give you an insight into this fascinating subject and go some distance to explaining why these items receive so much attention and earth-shattering prices. Shoes for many people fall into a similar category of not just simple things that you purchase and wear, but footwear that is lusted after, desired, and envied.

With all of these things considered, does that mean that every HNW client has £1,000,000 of clothing – no, but what it does mean is that a lot of these clients have not considered that the suit they had made at Henry Poole will no longer cost them £2,000, and that pair of Ferragamo’s may have even doubled since they bought them before that cruise, even a simple pair of jeans is almost £100 these days, and I wonder how many people have factored in swimwear or scarves?

What is very clear is that today’s collectables can be displayed, or worn and they all can still change value at an astonishing rate and need to be reviewed regularly. One of my current favourite trends is the astonishing market for rare basketball sneakers (that’s trainers in English) where the secondary market surpasses even Rolex for the biggest increase in value as soon as they walk, or at least are carried out of the shop.

Whilst a valuer cannot go through every drawer in a dressing room, it’s important to establish the client’s taste and style. Getting to know the client and their spending habits is vital to an accurate valuation – that and a keen eye for a pair of Gucci loafers…