What it means for you and your clients

February 2020, Rachel Doerr and I were sat in the law offices of Mishcon de Reya, having been asked to attend a discussion debating the 2018 Ivory Bill and how the enforcement and understanding of it would take place. Fast forward two months, and due to Covid, Ivory was the last thing on the minds of the government, or anyone else for that matter.

So, 2023 we are now at the point where the Ivory Bill of 2018 should now be clear in everyone’s minds, if you own ivory, or have clients with ivory – it’s even more important.

What Is It?

The Ivory Bill of 2018 was created to ensure that the United Kingdom was at the forefront of regulatory measures to assist in the reduction of the worldwide trade of ivory.

What was wrong with the old legislation?

To put it in simple terms – the understanding of the law. Many people unknowingly sold or bought ivory items that by definition, were illegal – but without expert opinion (and in some cases carbon dating equipment) it would have been impossible to be sure of what items were and were not legal, so the Ivory Bill 2018 was created.

What does the ivory bill mean now, in 2023?

The sale of most items of ivory within the United Kingdom is now illegal, therefore they will have no commercial value, there are some exemptions – here are the published examples by The Department for Environment, Food & Rural Affairs;

1. De minimis

Items with a volume of less than 10% by volume, and which were made prior to 1947. Items with this volume of ivory are not traded for their ivory content, and as such do not contribute to poaching. This limit will mean the UK has amongst the toughest approaches to this category of exemption internationally.

2. Musical instruments

Musical instruments with an ivory content of less than 20% and which were made prior to 1975. This will cover the vast majority of commonly used and traded instruments and accessories, such as pianos and violin bows.

3. Portrait miniatures

Portrait miniatures produced prior to 1918. Portrait miniatures are a discrete category of item which, although painted on thin slivers of ivory, are not valued for their ivory content. Sales of portrait miniatures will not fuel, directly or indirectly, the continued poaching of elephants.

4. The rarest and most important items of their type

Items made of, or containing, ivory produced prior to 1918 which are assessed by an independent advisory institution as of outstandingly high artistic, cultural or historical value, and are an example of the rarest and most important item of their type. These items are not valued for their ivory content, and the trade in them will not fuel the poaching of elephants.

5. Museums

Commercial activities which include sales, loans and exchanges to, and between, accredited museums. This ban will not affect the display of historic, artistic and cultural items to members of the public by accredited museums.

How does this impact my clients who own items of ivory?

If your client owns any items that fall outside of the exemptions this means they have no commercial value in the United Kingdom and cannot be sold under the Act.

If they are Exempt this means they potentially have a monitory value and will require a certificate of exemption from DEFRA to prove this before you can sell the item using the declare ivory scheme or hire out service.

It has become clear that some major insurers are now asking for any item that contains ivory to now have a certificate of exemption before it is insured – this can include many items, from furniture, to silver, and many other items. This will mean having a DEFRA certificate in the name of the client, not the retailer that it may have been purchased from.

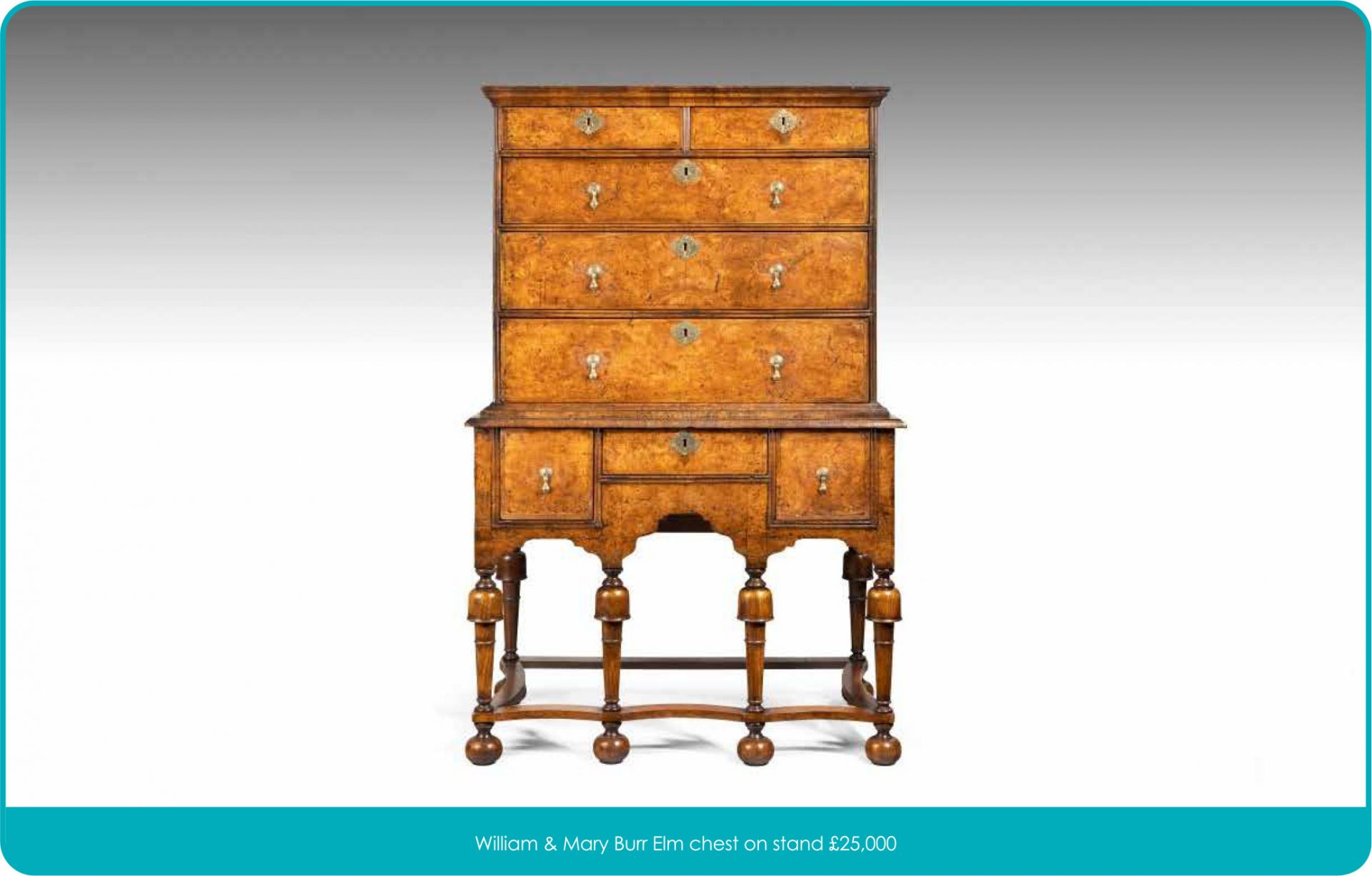

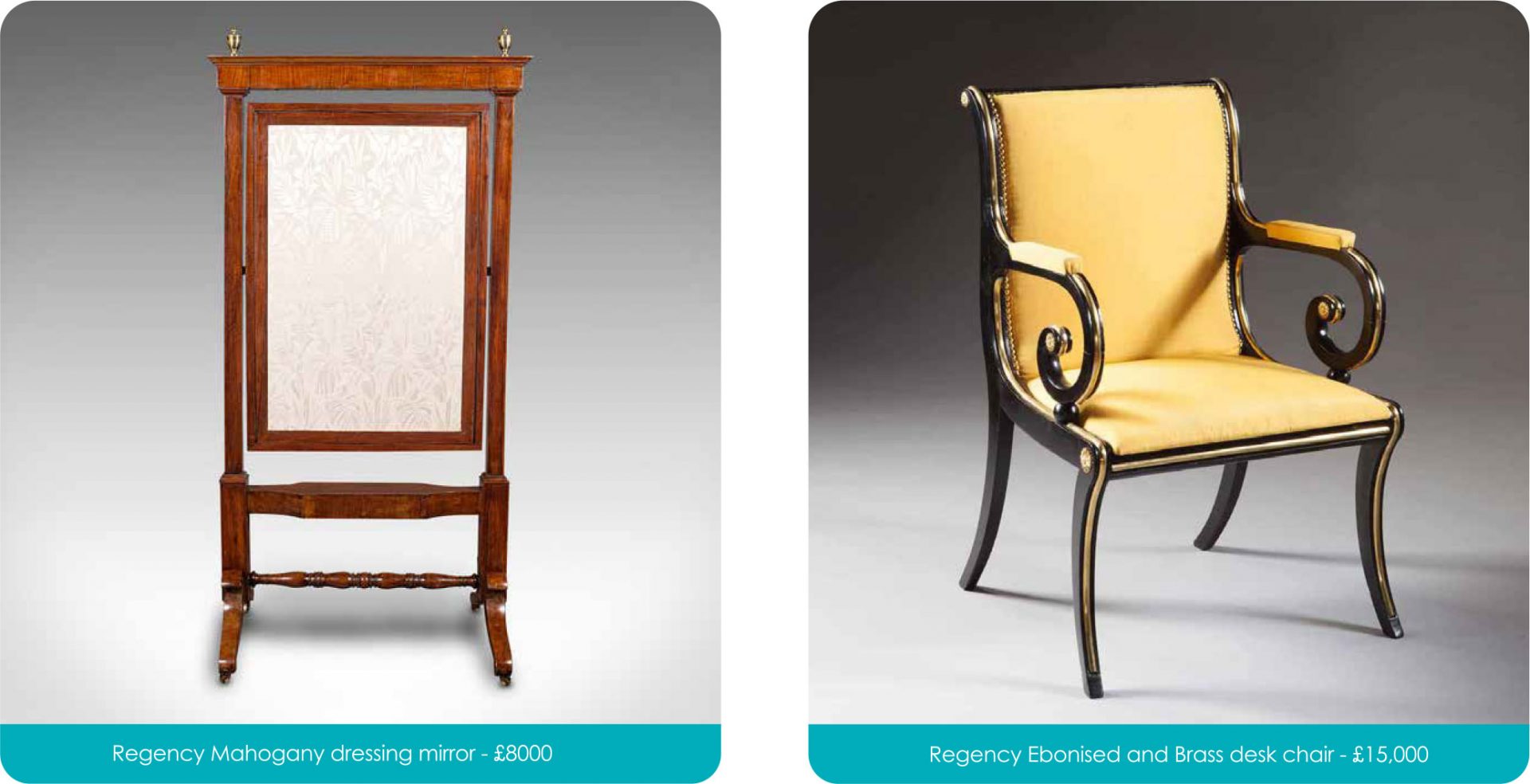

Ivory was used for many purposes in the 17th to 19th centuries whether that be for decorative or practical purposes and people may be surprised as to what includes ivory in their construction.

At Doerr Dallas Valuations we can help clients identify what may need certificates, and assist them in applying for them – speak to our team to find out how you can make sure you or your clients don’t fall through the cracks of this legislation that will impact the industry nationwide.