Continuing on the theme of famous female Old Master painters, I am turning my attention to Rachel Ruysch (1664-1750). She has many virtues. Apart from being a wonderful painter, she has been very thoughtful to future generations of scholars by almost always signing her works and giving her age, so a chronology of her oeuvre is simple to work out. This is a practice she began at 15 and continued until she was 83, although she lived to be 86 and was married for 52 years.

She had several advantages at the start of her career. The first of which was being born in the Hague to Frederick Ruysch, a professor of anatomy and botany (she was to become the most famous flower painter of her generation) and Maria Post, whose uncle Frans was a distinguished landscape painter famous for his views painted in the Dutch colony of Nieuw Holland, in Brazil. Another boon was to be apprenticed to the brilliant Delft still life painter Willem van Aelst (1627-1683), who had so impressed Ferdinand II de Medici, when court painter in Florence, that he gave van Aelst a gold medal and chain at a public ceremony to acknowledge his genius.

Her early works are forest floor scenes in the manner of Matthias Withoos and Otto Marseus van Schrieck, which allowed her to introduce various insects and lizards amongst the plant roots, which she would have copied as a child in her father’s private museum. He had invented a technique for embalming plants and animals, the secrets of which he refused to divulge.

At the age of 15 she was apprenticed to Willem van Aelst and he taught her the art of composing bunches of flowers in a vase in a naturalistic way, even though many of the plants could not have been blooming at the same time. The meticulously painted petals are enlivened by dewdrops, ants, caterpillars and other plant-loving insects.

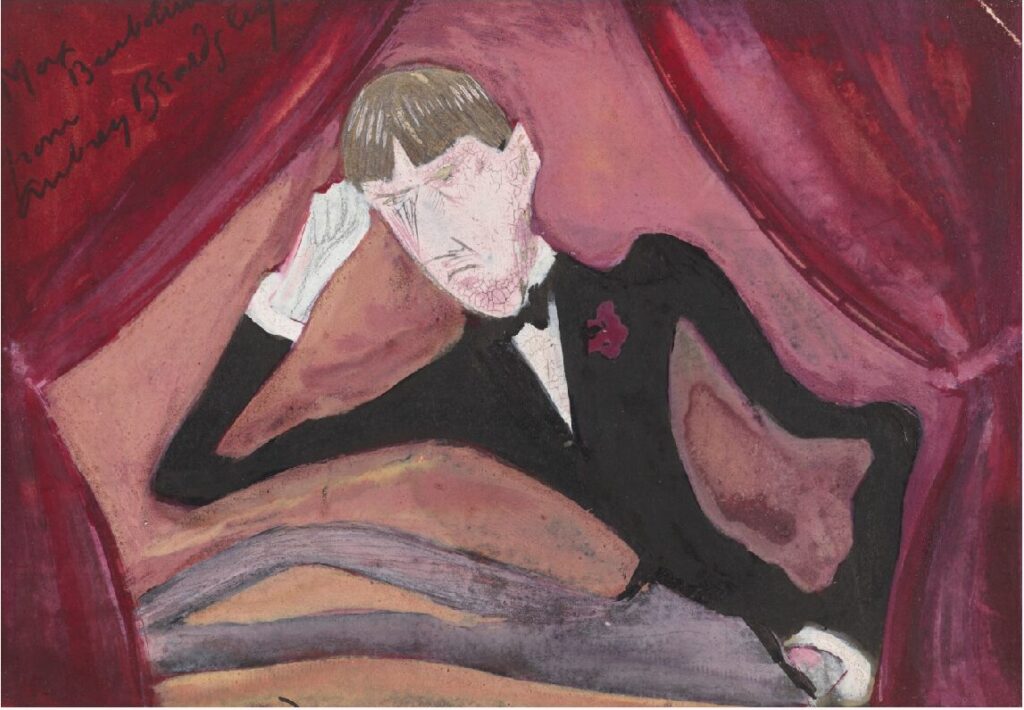

In 1693 she married the portrait painter Juriaen Pool and they subsequently had 10 children. Childcare was not a problem, as Rachel’s flower pieces sold for between 750-1,250 guilders. To put this in context, Rembrandt rarely received more than 500 guilders for a picture in his lifetime, but he did produce the ‘1000 guilder’ print. In the portrait of her by her husband, Juriaen Pool, she sits with her head in her right hand, a symbol of melancholy and genius, since antiquity, whilst her husband, who is in the background both physically and metaphorically, points to one of her pictures on the easel.

At the end of the century, she and Juriaen moved to The Hague and became members of the Painter’s Guild there in 1701. She was the first female member of the Artists’ Society, The Confrerie Pictura. From 1708-1716 she worked in Dusseldorf as Court Painter to Johann Wilhelm, the Elector Palatine.

She continued to produce brilliant flower still lifes into the middle of the 18th Century and her reputation was such that at her death in 1750, eleven poets paid their respects by writing poems about her.

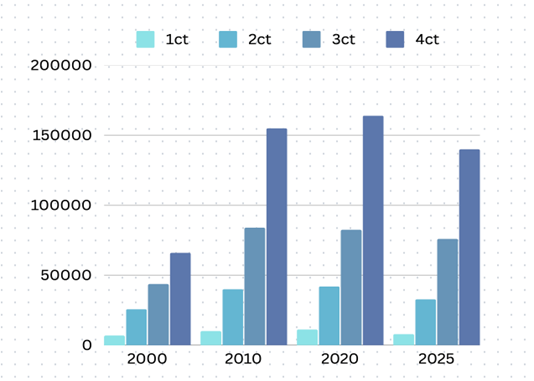

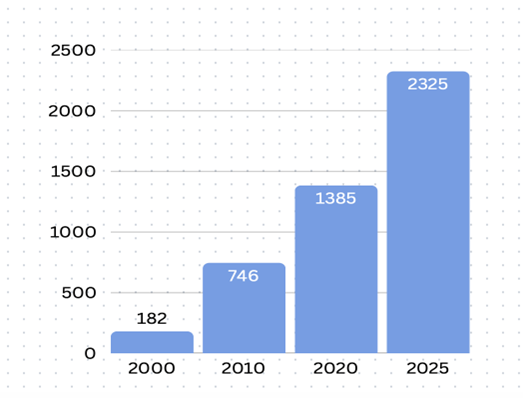

Although she has always been a sought-after artist by connoisseurs, she is not a household name today. As she was a relatively prolific painter, over 250 works by her are known, she appears at auction on a regular basis, 71 paintings in the last 35 years. The world record price at auction is £1.65M and 9 of her paintings have made more than half a million dollars. If you would like to see works by Rachel Ruysch, The National Gallery in London has three. Furthermore, there is a wonderful exhibition dedicated to her work, currently at the Altepinakotech in Munich until March 16th. It then relocates to Toledo, Ohio from April 13th – July 22nd and ends its tour at the MFA in Boston from August 23rd to December 7th. I think it more than justifies a trip to New England in the fall!

PS…

When she was around the age of 50, she won 70,000 guilders in a lottery and gave up painting for a while!