Download this article here

Mary Waterfall, Jewellery Specialist

The Brief: My Great Aunt Winnie has kindly gifted me £5K in her will. However she has also specified that I must spend it on something within my field of expertise, something that I believe will increase in value over the next five to ten years.

The Options:

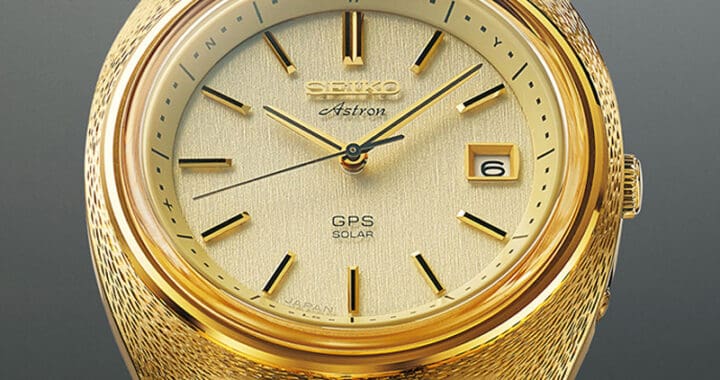

1) Gold

My immediate thought is that I would invest it in gold. The gold price does fluctuate but over a long period of time it usually increases. As I write this, in the final months of 2020, the gold price is quite high. One of the reasons for this is because of the uncertainty in the stock market due to the COVID 19 pandemic, traditionally when share prices go down, the gold price goes up. My plan would therefore be to wait until the markets stabilise, which could take a year or two, to ensure I’m not buying gold at a price peak time. I would then go to auction and buy gold in the form of Sovereigns, chains etc., put it all in a safe for five to ten years, keep an eye on the markets and look for an opportune time to sell and hopefully profit on the investment. I wouldn’t sell at auction though because I would have to pay commission for the privilege. I would go to a jewellers/dealers who buys gold. Then tend to give you a better price per gram the greater quantity you have.

However, that all sounds very good but I wouldn’t get much enjoyment out of that experience. I don’t really wear plain gold jewellery so it would just be locked away and not looked at. Wouldn’t my Great Aunt Winnie prefer me to buy something I would actually wear and love? So my next thought is:

2) Vintage Designer Jewellery

Historically the vintage jewellery of certain brands, such as Cartier and Van Cleef & Arpels, can hold and increase in value. Pieces made in the early to mid-twentieth century can be very desirable and sought after. Clearly it’s a piece by piece case and does not apply to all jewellery made at this time. The ‘rule’ doesn’t necessarily apply to more modern designer jewellery such as the Cartier Love bangle. If you do an auction house online search for these bangles you will see many examples come up. The market is pretty flooded with them at the moment and some of them are the amazingly impressive fakes that are coming out of Dubai, some of which are hard to tell from a genuine bangle if you don’t know what you are looking for.

Fake Cartier Love Bangle

There is also a bit of a myth that if the jewellery is ‘old’ it will naturally increase in value. Again it depends on the piece but generally this is not the case. I was recently asked to value a diamond bangle that had been marketed as ‘Georgian’ and ‘very rare’. However in reality it was a modern piece manufactured in India and was not as valuable as originally thought.

So I know I need to have my wits about me if purchasing at auction. Another question is will I actually find such a piece that is £5k or under because such items can command high prices.

There are a lot of beautiful brooches out there, which were highly fashionable at the time but not so nowadays. I may be tempted by something like these earrings.

Cartier earrings c1970

They are by Cartier, circa 1970 and sold for £3800 plus buyers premium. They are beautifully made, signed and numbered by Cartier and I would wear and enjoy them. However I may also be tempted to extend my search and try and find something within my price range that was made by Cartier slightly earlier.

Conclusion

I think there is more certainty of a profit in strategy one but more fun and enjoyment in strategy two. Which would you choose?