By Jonathan Horwich, Modern Art Specialist

L S Lowry, (1887-1976) is perhaps our most famous English painter of the 20th Century. Certainly, if you were appearing as a contestant on ‘Pointless’ then good luck trying for a pointless answer by naming Lowry as your answer in any question category! Most people in the UK today, young or old, and for some reason mostly male, will in some way or other have heard of Lowry.

As a Victorian, born in Manchester in 1887, he was the only child of Robert and Elizabeth Lowry. It seems he was always a disappointment to his mother, who really wanted a girl. Early photographs show him still wearing girls’ clothes aged 4 or 5. He also wanted to be an artist, which was yet another disappointment to his mother.

However, as the Lowrys were not wealthy enough to support the family, he was thwarted by having to work full time at his father Robert’s work place. This left no time for painting in the day, leaving him only the evenings to study, so that is what he did. Always older than everybody else, it took him the best part of 20 years to fully qualify. Even then, (although he never admitted it to anybody he knew), he had to continue to work full time, Monday to Saturday, and so only painted at night for many, many years. Indeed, probably through habit he continued to do this his whole life.

He was at his most productive after he retired from the Pall Mall Property company in 1952, when at least he had the whole day at his disposal. He was by then famous for his Industrial Landscapes which he began painting in the 1920’s. On retirement, he was keen to move on but inevitably his collectors still mostly wanted his ‘Industrials’.

He switched to a lighter, brighter, whiter, palate by the early 60’s and began to make small, quickly painted pictures, mainly with people and animals.

He has always been a popular artist at auction and as early as 1964 pictures were reaching record sums of near to £2,000, a very significant sum back in the day. His exhibitions in London at the Lefevre gallery were always a sell-out and so now prices for even small, genuine drawings and sketches are out of the reach for many collectors.

Limited edition prints had been around since the beginning of the 20th Century, with artists such as Picasso and Henry Moore signing limited editions of their printed work.

Lowry became involved in the late 60’s and early 70’s, signing everything personally. It is these that offer the new collector at least an entry level starting point as a collector. Generally speaking, the price range runs from £2,000 up to the dizzy heights of £20,000 for particularly rare examples.

This article gives a brief introduction to the 25 to 30 different signed prints by Lowry that are still available. They regularly come up for auction and are available in private galleries all around the UK. As they are multiples, they are a bit like buses – if you miss one, there will be another along soon. Hence, there is no need to jump in quickly. If this is something that you want to get involved with, see what’s out there and then dip your toe in the water .

Things to watch out for are – condition and colour, (some prints fade if they’ve been in strong sunlight), and avoid stains and rips. Good luck and enjoy the process!

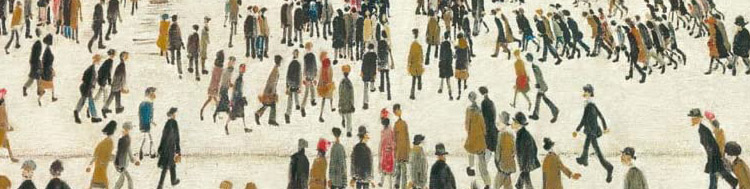

LS Lowry (1887-1976)

1-3 are all original Lowry paintings

1) Going to the Match, 1953

Signed, oil on canvas, 71 x 92. This is an image of the original oil bought at the 1997 auction by Graham Taylor on behalf of the Professional Football association pension fund, it’s now on view in the Lowry Salford

Original oil painting, Sold at auction for £1,926,500 in 1997

2) The original Lowry painting Station Approach, Manchester 1960, oil on canvas, 76 x 101 cm

Sold for £2,322,500 in 2014

3) The original Lowry painting Punch and Judy. Signed and dated 1943, Oil on canvas, 41 x 56 cm

This original painting has changed hands multiple time since it first came up for auction in 1995 when it made £152,000, last time it sold was in 2019 when it made £611,000

Sold for £962,500 in 2014

The following are all signed limited edition prints of various original Lowry pictures and drawings

Going to the Match, 1953. Signed Colour print from an edition of 300, 56 x 70 cm

While the price paid for the original is not the record price the print version is the top priced Lowry print! It is to do with the subject, ie football and the fact that there were only ever 300 produced

£20,000 in 2020

£18,000 in 2015

Station Approach, Manchester. Signed colour print from an edition of 850, 40 x 50 cm

£3,187 in 2020

£3,100 in 2015

Punch and Judy. Signed colour print from an edition of 75, 44.5 x 68.5 cm

Prices go down as well as up, the price for this particular print has gone down since 2015…

£5,062 in 2020

£8,100 in 2015

Britain at Play. Signed colour print from an edition of 850, 47 x 60 cm

£4,200 in 2021

£2,500 in 2015

Fever Van. Signed colour print from an edition of 700, 45 x 54 cm

£4,800 in 2021

£2,500 in 2015

The Pond. Signed colour print from an edition of 850, 45 x 58 cm

£4,000 in 2021

£2,200 in 2015

Market Scene in a Northern Town. Signed colour print, 46 x 60 cm

£5,000 in 2021

£2,700 in 2015

Man Lying on a Wall. Signed colour print. No 479 from an edition of 500, 40 x 50 cm

£7,200 in 2020

£6,000 in 2015

Group of Children. Signed colour print from an edition of 850, 18 x 19 cm

£3,825 in 2020

£1,800 in 2015

The Contraption. Signed Colour print from an edition of 750, 31 x 30 cm

£4,000 in 2020

£2,100 in 2015

Great Ancoats Street. Signed b/w print, from an edition of 850, 26 x 36 cm

£2,800 in 2020

£1500 in 2015

Salford Viaduct. Signed, monochrome, lithograph from an edition of 75, 52 x 64 cm

£7,000 in 2021

Rare print, only two have been offered at auction, one sold for £6500 in 2016

Deal Beach, sketch. Signed colour print from an edition of 850, 26 x 50 cm

£5,000 in 2019

£3,500 in 2015

Burford Church. Signed colour print from a numbered edition of 850, 60 x 45 cm

£2,200 in 2020

£3,100 in 2015

A Street full of people. Signed b/w print from a numbered edition of 75, 62 x 97 cm. This particular print is no 2/75 and was embellished in blue crayon by Lowry himself which doubled its price to £20,000!

£10,000 in 2020. It’s a rare print only 5 have come up, one made £800 in 2012

Mrs Swindell’s picture. Signed colour print from an edition of 850, 40 x 30 cm

£3200 in 2020

£1600 in 2015

The Football Match. Signed and numbered black and white print from an edition of 850, 26 x 36 cm

£5,737 in 2021

£4750 in 2015

Three Men and a cat. Signed in blue biro, colour print, 25 x 17 cm

£3600 in 2020

£1800 in 2015

His Family. Signed colour print from an edition of 575, 54 x 72 cm

£1785 in 2020

£1600 in 2015