The price of diamonds is said to be tumbling and crashing with major players such as De Beers even cancelling sight holdings over the summer due to poor demand. And yet… When I scroll through the big brands, all I see are numbers going up, up and up! So, let’s not panic too quickly and think that all our investments – that is if you’re lucky enough to have been able to invest in jewellery, watches and diamonds – are all collapsing and you’ve lost everything.

The main issue here, and seems to be across the board, is a form of misinformation. The media is quick to react to market trends but doesn’t take into consideration other factors that apply when jewellery is made and then sold. To make a piece of jewellery one needs the raw material, diamonds and gold for example, along with workforce. The only factor in this equation which has dropped are indeed the diamonds. But all other costs keep climbing.

So why has the diamond market slowed down? Which market are we even talking about? Has the jewellery market slowed with the depreciation of diamond?

It does appear that both synthetic and natural diamond markets have weakened. With more companies offering the cheaper option to natural diamonds, it’s no wonder that the synthetic diamond market has plummeted, even with the best marketing. Giant De Beers had indeed noticed the trend would not pick up and decided, in June 2024, to close its synthetic diamond branch “LightBox lab-grown diamond”.

Lab-grown diamonds have almost become synonym of fashion jewellery and De Beers’ strategy was to give natural diamonds their spark back and focus on high-end diamond jewellery. Both markets have slowed, with the synthetic diamond market doing so even more than the natural diamond market. Is it a bad thing? That’s open to discussion: making diamonds more accessible and traceable than natural, but robbing customers of the experience of getting to buy a piece of natural history. There are endless arguments for and against.

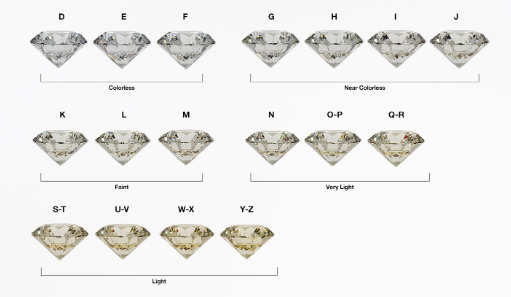

But still, why has the natural diamond market also slowed down? That is in part due to sluggish Chinese demand and worldwide geo-political issues. However, the best diamonds, D, Flawless, are still in high demand, as are the bigger carat diamonds. The larger the carat weight the bigger the jump in percentage increase. There is a huge difference between a 1 carat diamond and a 1.50cts diamond for example. With all criteria remaining the same, the increase can be more than 50% per carat depending on the retailer. De Beers are currently retailing a 1ct brilliant-cut diamond G, VS2, for £15,800 and a 1.50cts with identical colour and clarity for £34,200.

Other than for solitaire diamonds of a certain colour and clarity (for example H/I coloured diamonds with a clarity under VS2), when it comes to completed jewellery pieces, the prices do not seem to be declining either. Why? Because couples are still getting engaged, young people are still having “big” birthdays commemorated with diamond gifts. Whatever the reason, diamonds maintain their desirability and durability.

A pair of Tiffany & Co. Victoria diamond earrings have gone from £3,100 in 2003, £4,925 in 2010, £8,775 in 2021 and up to a current value of £9,125.

It still seems good business and good investment to be buying jewellery and diamonds. Though one might need to hold on to a few middle market diamonds until the values pick up again, when it comes to branded pieces, such as De Beers or Tiffany & Co. as we have cited, it still seems to be a safe investment with return on investment definitely worth the waiting for. With values of signed pieces creeping up and diamond markets fluctuating as do the insurance values. Be sure to keep get your valuations updated as you could be under-insured and very possibly over-insured too.

Aurélia has over twenty years’ experience in the auction industry. She started her career in Business Development and Client Services at Christie’s and Sotheby’s Paris.

- Aurélia Turrall#molongui-disabled-link

- Aurélia Turrall#molongui-disabled-link

- Aurélia Turrall#molongui-disabled-link

- Aurélia Turrall#molongui-disabled-link